Campaign check: Warnock says Loeffler backs higher middle class taxes

The statement:

“Loeffler’s for raising taxes on Georgia’s middle class,” -The Rev. Raphael Warnock campaign ad

What we found:

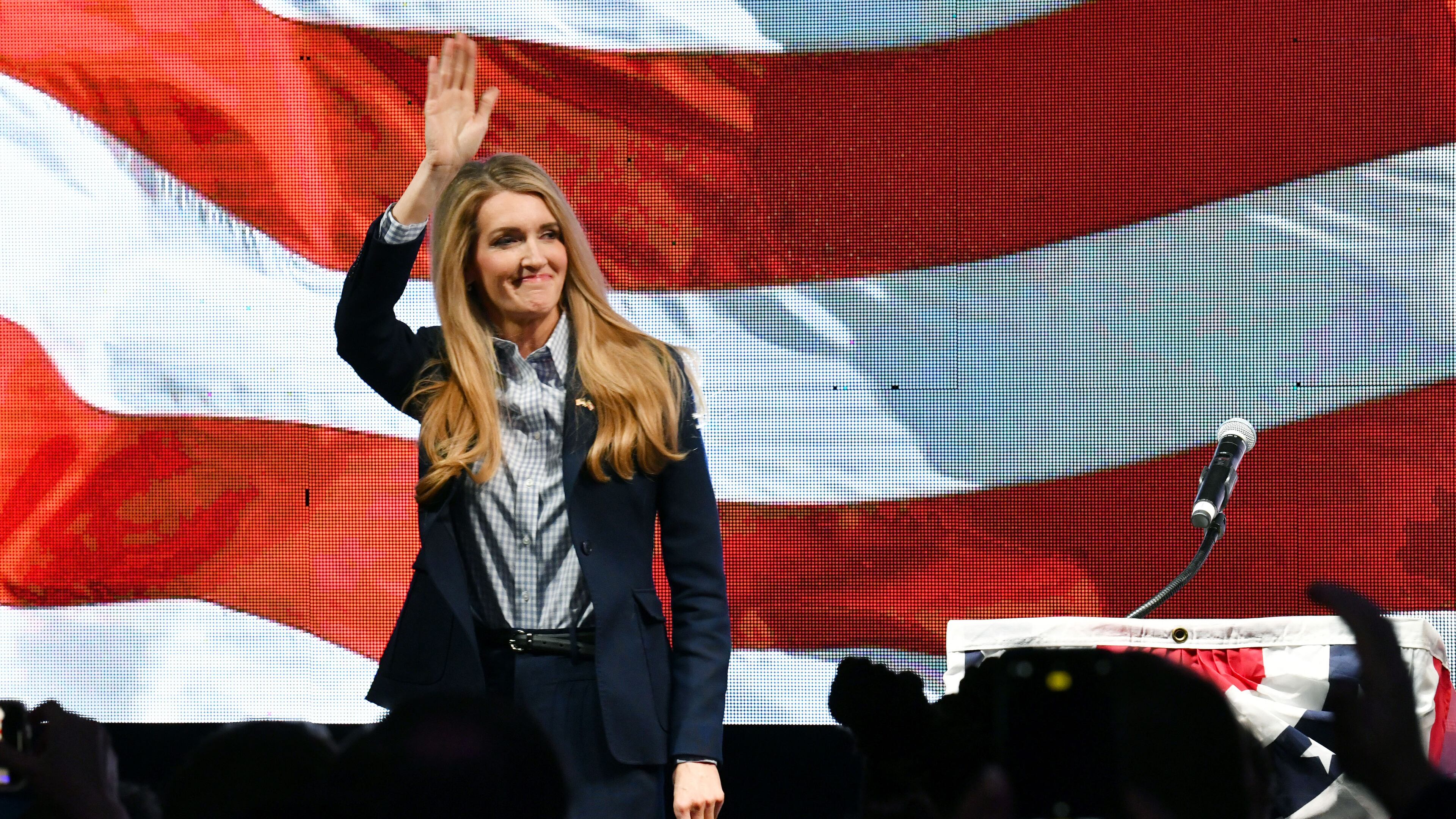

In the course of Democrat Raphael Warnock’s race against Republican Sen. Kelly Loeffler in the January runoff election, his campaign has highlighted her wealth and suggested she puts her financial interests above the that of her constituents.

One Warnock ad, “The Cayman Islands,” said that Loeffler supports raising taxes on Georgia’s middle class. The ad cites an October commentary in the New York Times about Republican’s overhaul of federal tax law, the 2017 Tax Cuts and Jobs Act.

That statement in the Warnock’s ad is false, according to PolitiFact and FactCheck.org, two non-partisan organizations that investigate political statements. Here’s the background:

Three years ago, President Donald Trump signed a sweeping Republican-driven federal tax law that provided a significant reduction in the corporate tax rate. Taxes cuts given to individuals and “pass through” businesses were set to expire in 2025. (With pass-through businesses, income is taxed through individuals, the Washington Post reported.)

Critics said the law unfairly favored corporations and wealthy individuals over middle- and working-class families, including 400 wealthy taxpayers who signed a letter to Congress opposing it, the Washington Post reported.

Loeffler didn’t vote for Trump’s tax plan because she wasn’t yet a U.S. senator. But she expressed her support after joining the Senate in January, due to an appointment by Gov. Brian Kemp.

She wants to make the law’s “tax cuts for working and middle class families permanent,” according to an economic plan posted on her campaign’s website.

The Warnock campaign suggests that Loeffler’s support for a tax cut that will expire is the same as supporting a tax increase. But Loeffler’s campaign and fact-checking sites balk at the characterization.

“Kelly Loeffler’s support of a tax cut that expires isn’t support of a tax hike,” the PolitiFact report said.

The Warnock campaign has pointed to Loeffler’s record in the U.S. Senate as evidence that their assertion is accurate. It notes that Loeffler has not introduced legislation that would extend the tax cuts despite the fact that she introduced other bills that address parts of her economic plan, FactCheck.org reported.

“The wealthiest person in Congress, Kelly Loeffler used a loophole to write off her multimillion-dollar private jet while supporting legislation that made tax cuts for wealthy corporations permanent and will result in the middle class paying more,” Warnock campaign spokesman Michael J. Brewer said in an email to The Atlanta Journal-Constitution.

“Despite being in the Senate for nearly a year, she didn’t introduce any legislation to fix the problem,” Brewer said.

The Loeffler campaign sees it differently.

“As a successful businessperson, Kelly spent 30 years in the private sector creating jobs, balancing budgets and fighting for lower taxes — and that’s exactly what she has championed every single day in the U.S. Senate,” Stephen Lawson, Loeffler campaign spokesman, told the AJC.

During an October debate at The Atlanta Press Club, Warnock was pressed by an AJC reporter to describe what tax policies are needed due to the pandemic.

“What I support is that we ought to give middle-class families and poor families a break right about now,” Warnock said. “I want us to start thinking about the things we can do to give people a living wage.”

Warnock’s campaign website says he “will oppose Washington tax breaks that benefit the richest of the rich while leaving behind the poor and working families that need help the most.”

Warnock’s net worth is between $555,014 and $1.3 million, The AJC reported, while Loeffler’s net worth is between $300 million and $800 million.

In terms of Trump’s tax law, a Warnock campaign spokesman told FactCheck.org that Warnock “believes the permanent tax cuts for the wealthiest and corporations should be repealed and that Congress should make permanent the tax breaks for the middle class, which would otherwise expire.”