The final score is in on the Braves’ 2020 financial performance, and it’s not pretty.

The Braves’ revenue declined by 63%, falling from a franchise-record $476 million in 2019 to $178 million in 2020, as a result of a shortened season played without fans in the stands, according to figures disclosed Friday by team owner Liberty Media.

The Braves had an operating loss before depreciation and amortization of $49 million last year, representing a negative swing of $103 million from a profit of $54 million in 2019, the company said.

Liberty Media said in its financial report that of the Braves’ $178 million in 2020 revenue, $142 million came from baseball sources, down from $438 million in 2019. The other $36 million came from real-estate development The Battery Atlanta, down from $38 million the year before. Total revenue declined $298 million from 2019.

Such baseball revenue sources as ticket and concession sales were shut off in 2020 as games were played amid the COVID-19 pandemic without fans in attendance. The reduced number of games “also negatively impacted broadcasting revenue,” Liberty Media noted. Other revenue streams, such as sponsorships and parking, also were affected.

Liberty Media President and CEO Greg Maffei said on a conference call with investment analysts Friday that he expects the Braves to have fans in the stands at Truist Park to some extent this year.

“Ninety-seven percent of The Battery’s tenants are operational, which speaks to the relative openness of Georgia and we believe bodes well for fans at Truist this year,” Maffei said. “We do expect to have fans in the stands, but are not yet sure of the seating capacity restrictions. And we do have significant demand for tickets, both at Truist and spring training.

“We look forward to a great 2021 season, including hosting the MLB All-Star game on July 13.”

Later on the call, Maffei suggested the Braves might start the season at 25% seating capacity, although that has not yet been determined.

“We will be in far better shape in terms of the fan attendance than if you were in New York or California or some other locale,” Maffei said. “It will be decided not by baseball, but by the local rules and authorities.”

While the Braves’ revenue was down sharply last year, expenses also were down. That largely was because player salaries were prorated to reflect the shorter season and because game-day costs were lower. The Braves also had pay cuts and widespread layoffs on the baseball operations and business sides of the organization.

The Braves’ debt at the end of 2020 was $674 million, down from $714 million Sept. 30, but up from $559 million at the end of 2019. The debt mostly stems from the construction of Truist Park (formerly SunTrust Park) and a new spring training complex and the continuing construction of The Battery.

Operating profit or loss before depreciation and amortization is the most common metric, along with revenue, for measuring the financial performance of a pro sports franchise. But after subtracting $69 million in depreciation and amortization and $3 million in stock-based compensation, the Braves showed a loss of $121 million for 2020, compared with a loss of $32 million after depreciation, amortization and stock-based compensation in 2019, according to Liberty Media’s disclosures.

Last year’s financial losses prodded the Braves and many other MLB teams to cut spending for the 2021 season. The Braves currently have a projected opening-day payroll of about $129 million, down from what would have been $152 million if a full season had been played last year. Their player payroll ranks 14th among the 30 MLB teams and fourth among the five National League East teams.

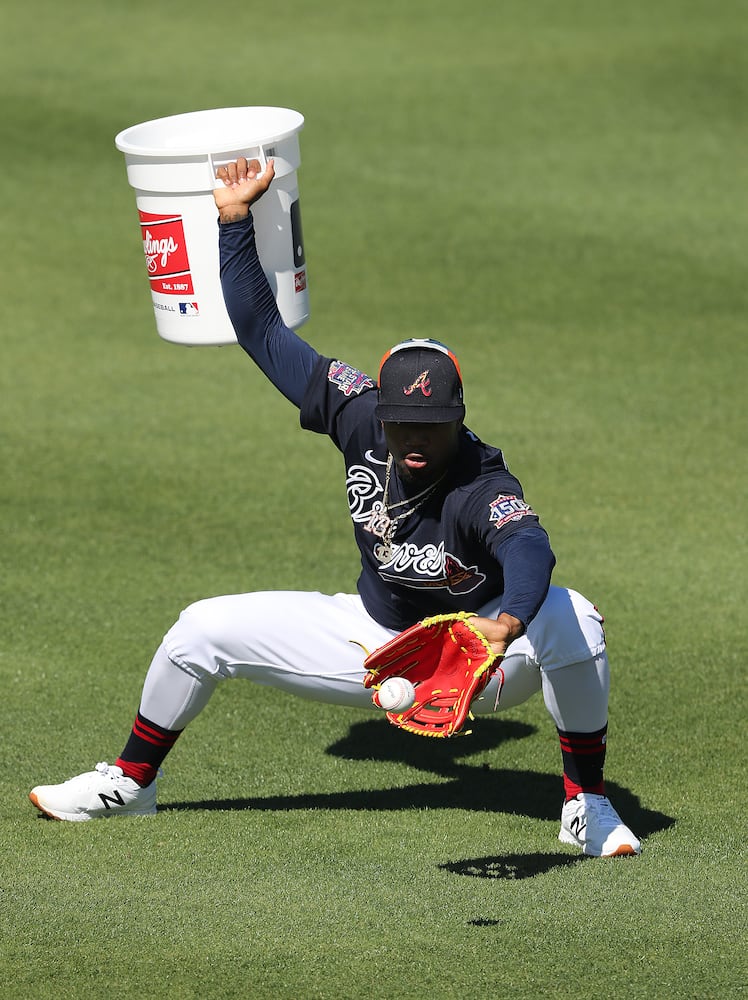

During the offseason, the Braves re-signed outfielder Marcell Ozuna to a four-year contract and added free-agent starting pitchers Charlie Morton and Drew Smyly on one-year deals. The Braves cut spending in other areas, particularly the bullpen.

“We are excited about our enhanced 2021 roster,” Maffei said. “We came within one win of going to last year’s World Series, so our guys are ready to go.”

As one of the few U.S. sports franchises with publicly traded stock, the Braves are required to disclose their financial results on a quarterly basis.

About the Author

Keep Reading

The Latest

Featured