Budget writers agreed Monday on a midyear spending plan that includes a property tax cut of about $1 billion and repays the Georgia Department of Transportation $1.1 billion it lost last year when the state suspended the motor fuel tax to stem the impact of high gas prices.

Fuel taxes pay for road projects, and the $1.1 billion will go toward keeping GDOT programs rolling.

The full House and Senate ratified the deal later Monday. The midyear budget now heads to Gov. Brian Kemp for his signature.

The Georgia Senate is also considering a $1 billion income tax rebate that Kemp has proposed, a measure that has already passed the House.

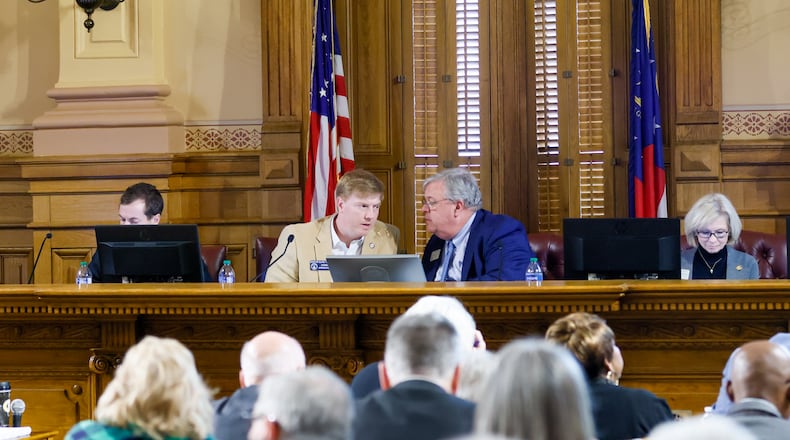

The House and Senate budget conferees on Monday backed an overall $32.5 billion midyear budget, which runs through June 30. It would build on consecutive years of massive tax surpluses the state has seen since the COVID-19 economic shutdown ended in the spring of 2020. It would increase spending by about $2.36 billion or 7.8% — which Senate Appropriations Chairman Blake Tillery, R-Vidalia, said is in line with inflation.

Under the spending plan, homeowners would receive an extra one-time exemption on the value of their homes at tax time, a move that Kemp said in January would save those Georgians, on average, about $500. It would cost the state about $950 million.

Under legislation the Senate is expected to approve soon and Kemp proposed, many Georgians would also receive an income tax rebate, as they did last year — $500 for married couples who file jointly and $250 for single filers.

Lawmakers included money in the midyear budget for $50,000 safety grants in each school, money to help students who may have fallen behind academically during the COVID-19 pandemic, and more money in dozens of other areas, such as health care, rural workforce housing development, prisons and public safety.

Budget writers added funding to give 54,000 state government pensioners one-time bonuses of $500. State government pensioners got their first cost-of-living increase in more than a decade last year, although lawmakers have offered bonus checks some years.

They included $166.7 million to help fund large economic development projects in the state, including new Rivian and Hyundai car plants.

House Appropriations Committee Chairman Matt Hatchett, R-Dublin told conferees he is hoping to have a budget proposal for fiscal 2024 — which begins July 1 — out later this week. The General Assembly must pass a final budget for the upcoming year before it adjourns in late March.

State revenue collections are expected to be down this year, meaning lawmakers will have less money to allocate as inflation continues to raise the cost of what government does. Tillery and Hatchett have warned that the economy may slow, so the state won’t have as much money to work with in the second half of the year.

About the Author

Keep Reading

The Latest

Featured