Georgia legislative leaders push limits on property tax increases

A key Georgia Senate panel is expected to move soon to slow the rate of property tax hikes especially prevalent in metro Atlanta by backing legislation to limit how much home assessments can go up to 3% a year.

The move comes less than a week after House Speaker Jon Burns, R-Newington, announced legislation to double the standard state homestead exemption on property from $2,000 to $4,000 a year, a measure he said could cut property taxes by $100 million a year.

Both efforts are aimed at helping homeowners who, in some areas, have complained about being taxed off their property as assessments have skyrocketed with the booming housing market even as tax rates have remained stable.

A homeowner’s property tax bill is mostly made up of two elements: the tax rate and the assessed value of their property. School districts, cities and counties have been able to count on a boost in revenue without raising tax rates because the assessed value of homes and businesses in some areas have risen sharply.

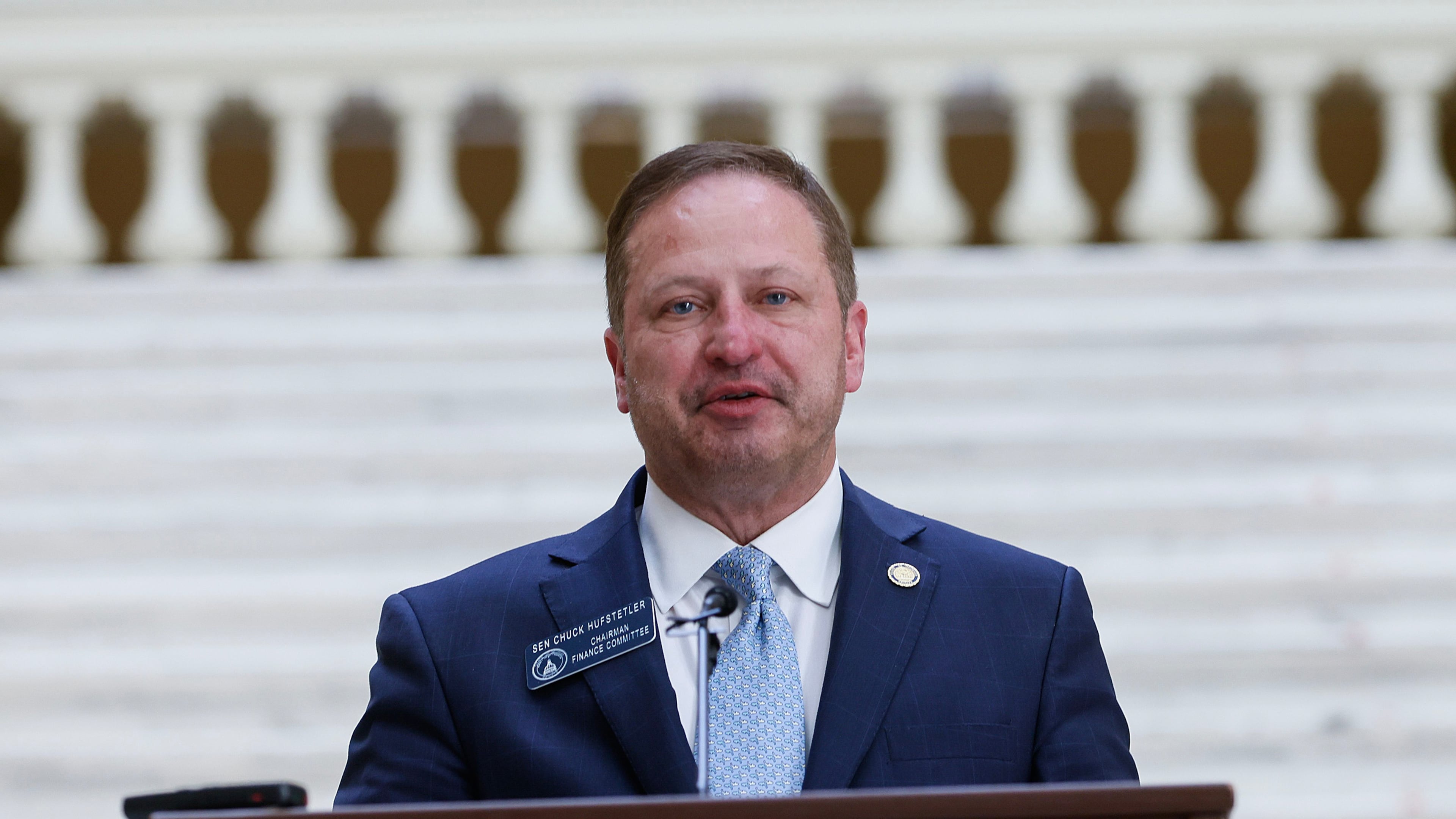

“We’ve probably heard more about property taxes than we’ve heard about any other issue in the past year,” said Senate Finance Chairman Chuck Hufstetler, R-Rome, who is sponsoring one assessment bill and co-sponsoring another. “We’ve seen property tax increases — just solely on the assessed value — of 25, 30 and even 40%.”

At least 39 Georgia counties, 35 cities and 27 school systems have adopted local measures limiting how much assessed values can rise. Some of them only benefit homeowners 65 or older.

A 3% cap on assessment increases could mean local governments and schools would have to raise tax rates, but some lawmakers say at least that would make the process more transparent to homeowners, many of whom don’t understand why their home is valued at what it is.

“We need to be careful, some of these people can’t stay in their houses because of the taxes,” Sen. Brandon Beach, R-Alpharetta, said during a recent Senate Finance Committee hearing.

As long as Georgians have been charged property taxes to pay for schools, public safety, roads and other services, lawmakers have heard complaints about them.

Democratic Gov. Roy Barnes in the late 1990s passed a “homeowners bill of rights” and a tax credit on property tax bills. When Republicans took over the General Assembly, then-Speaker Glenn Richardson crusaded against rising property taxes — and Republican lawmakers floated the idea of replacing property taxes with higher sales taxes to pay for schools.

A swap from property taxes to sales taxes was first floated in Georgia in the 1990s, but the idea was criticized as bad for low-income families — who pay a higher percentage of what they earn in sales taxes — and potentially damaging to school systems. Sales tax collections are also seen as especially sensitive to downturns in the economy.

Critics say one of the issues with the current system is that in some counties, big commercial property is undervalued by assessors, shifting the burden to smaller businesses and homeowners to pay for vital services.

Some local officials like the idea of a cap on homeowner assessments; others find caps problematic. For instance, school districts generally have a cap on their tax rate at 20 mills, although a few systems have higher rates. So if growth in property digests are limited, many districts might quickly run up against that 20-mill cap.

Columbus-Muscogee County began freezing property values for assessment purposes in 1983, and Suzanne Widenhouse, the chief appraiser there, said tens of thousands of homeowners today pay less than $100 a year in property taxes.

That means newer homeowners and businesses play an outsized role in funding services. She showed the committee an example of two neighbors, one whose property value had long been frozen and paid $7.79 in property taxes, and another who paid $3,236 because they had more recently bought their home.

“Any time you talk about capping values, you create inequality,” she said.

Because so many homeowners have had their home values frozen for decades, the county has one of the highest property tax rates in the state, and it has seen its sales tax rate more than double. Those high rates, she said, have slowed the pace of economic growth and made it more difficult to attract businesses.

But the freeze is highly popular with longtime homeowners, who have paid little in property taxes for years, so efforts to change the system have been voted down.

“Once it’s in place, it’s impossible to claw back, " she said.

How your property taxes are determined

The property value is the full market value appraised by the county assessors. All property in Georgia is taxed at an assessment rate of 40% of its “full market value.” Exemptions, such as a homestead exemption, reduce the taxable value of your property. Millage rates are approved by local cities, counties and school boards, and what you pay is essentially the millage rate times 40% of the assessed value, minus exemptions.

Capitol Recap: The 2024 Legislative Session

Want to know what legislators did this past week and how it might affect you? Check out our weekly newsletter, Capitol Recap: The 2024 Legislative Session, every Friday.

To subscribe, go to https://www.ajc.com/subscribe-2024-legislative-session/.