A Gwinnett County toxicology lab accused in a kickback scheme to bilk Medicare out of millions of tax dollars is causing headaches for people around the nation as debt collectors try to collect on alleged unpaid lab bills.

For Deborah Smith of Houston, Texas, the calls started this spring from a debt collection agency seeking $1,400 in past due bills for urinalysis tests for her adult son. There was no explanation, no paperwork — just a bill.

“I’m getting a phone call every day now,” she said. “We already paid $125 for each drug screen each time he went to the doctor.”

For Tara Ross, another Texas resident, the bill was $1,000 for a test allegedly done in November 2015. Ross asked the debt collector to show her some documentation explaining the charge. She hasn’t heard back from them, so she called her doctor.

“He was like, ‘Throw it away. Don’t pay it,’” she said.

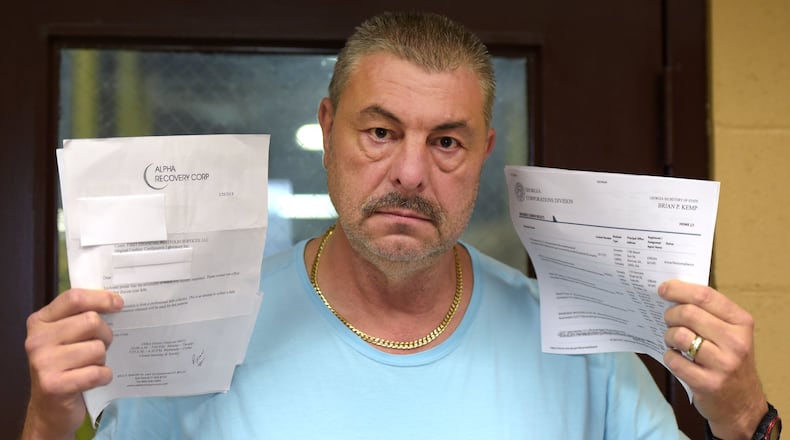

Then there is Richard Carter, who lives in Thomasville, Ga. Carter received a “past due” notice from a bill collector for $1,600.

"Supposedly this was drug testing, urine samples," Carter, 65, said. "I have never had any of that done."

Smith, Ross, Carter and others who contacted The Atlanta Journal-Constitution wondered why they suddenly were getting calls about alleged “past-due” bills for tests performed by a lab they had never heard of: Confirmatrix Laboratory.

A complex web of ownership

Confirmatrix filed for bankruptcy in 2016 just days after federal agents raided its Lawrenceville offices, carting off boxes of paperwork. Amid suspicions that it was overbilling the government and private insurance companies, the firm sought protection in federal court while restructuring millions of dollars in debt.

To pay creditors, the court ordered Confirmatrix’s records of unpaid lab procedures sold at auction. Since then, debt collectors have been calling confused patients who say they never received a bill and have never heard of the company.

It's the latest twist in the shadowy world of Khalid Satary, a Palestinian national who built a drug testing empire in Atlanta's northern suburbs over the course of the decade. The 46-year-old Satary founded a series of companies, bought million dollar homes and positioned himself as a philanthropic supporter of Islamic education and arts despite having been released from federal prison just 10 years ago.

Satary, who went under the name DJ Rock, served more than three years in federal prison for running a counterfeit CD operation across Georgia valued at $50 million.

Federal immigration officials have been trying to deport Satary since his release from prison but have been unable to find a country willing to take him. State records show Satary placed much of the family’s personal and business wealth in the hands of his American-born son, Jordan, when the boy was still a teenager, including the $1.2 million family home in Suwanee.

In 2016, Jordan Satary transferred the Suwanee home to an associate for $1, according to Gwinnett County records.

Much of the Satary business empire is hidden behind a complicated corporate structure. Records show Shiraz Holdings LLC, a Florida company wholly owned by Jordan Satary, was (via another LCC) a primary shareholder for Confirmatrix and the sole owner of GNOS Medical, another Lawrenceville firm that handled Confirmatrix’s billing.

Shiraz filed bankruptcy in federal court in Florida in June 2017 just before Confirmatrix closed its doors for good. Disclosures in that bankruptcy show large cash loans to Khalid Satary and Jordan Satary and a debt of $3.6 million to Confirmatrix. It also lists a $2.6 million waterfront home in Delray Beach, Fla., as among the company’s holdings.

In a hearing on Confirmatrix’s bankruptcy in Atlanta last month, Confirmatrix’s attorney J. William Boone cited the Florida case in his argument to close out the lab’s bankruptcy because there was no hope to finding additional funds to pay creditors.

The trustee assigned by the Justice Department to oversee the Confirmatrix bankruptcy objected to the motion to dismiss the case, asking for an independent investigation into the management of the company. U.S. Bankruptcy Judge Paul W. Bonapfel overruled the objection and dismissed the bankruptcy.

Criminal conspiracy alleged

Evidence of Confirmatrix’s questionable business practices have turned up in a long-running federal investigation into a network of “pill mills” around Knoxville in which the lab is said to have played a role.

A federal indictment in that investigation claimed Confirmatrix bribed providers for accounts and then overbilled federal insurance programs by performing unnecessary testing on the urine samples.

Guilty pleas entered by two of the conspirators claim Confirmatrix routinely made medically unnecessary tests on urine samples as a way to overcharge the government and private insurance companies. Samples sent for testing by uninsured patients did not receive the unneeded tests and charges often went unbilled, according to the plea agreements two defendants in the probe.

No one affiliated with Confirmatrix has been charged with a crime in the ongoing investigation. But court documents claim Confirmatrix and another lab, Seattle-based Sterling Laboratories, scammed $2.9 million from taxpayer-backed Medicare and Medicaid programs. And that figure only represents alleged losses in the east Tennessee pill mill ring.

The Tennessee case is at least the fourth time that companies associated with Satary have come under federal scrutiny.

Four years ago, the AJC reported that Satary and the company’s employees were being investigated for potential campaign finance violations in connection with a lavish fundraiser for then-U.S. Rep. Jack Kingston’s Senate campaign. The fundraiser netted more than $80,000 from employees of Confirmatrix and associated companies.

The pattern of contributions from employees — almost all of whom had never donated to a federal candidate before — suggested the possibility of improper bundling of donations. A whistleblower told the AJC at the time that employees were reimbursed for their donations, which if true would have violated federal law.

Kingston lost the Republican primary runoff to businessman David Perdue, who won the general election that November, and the federal investigation into the fundraiser was dropped.

‘Information was missing’

While Confirmatrix no longer exists, its accounts live on in the hands of debt collectors.

Prior to ceasing operations last August, the lab hired NYX Health, an Alpharetta-based medical billing company that specializes in collecting past-due accounts, to try to collect nearly $39 million the company said it was owed. Initially, NYX projected it would collect about $4 million, but instead netted just $300,000.

In describing the state of Confirmatrix’s accounts, Boone said “some of the information was missing” and there was evidence of “overbilling, any number of things.”

NYX President Gregory Wachowiak declined to comment. But in a statement filed with the court last month, he said his company “encountered numerous unanticipated difficulties” in trying to collect on the accounts, including denials of payment from government and private insurers.

“The remaining amounts of accounts receivable are primarily patient accounts receivable which are missing key information such as Social Security numbers, dates of birth, addresses, etc.” Wachowiak said.

Based on Confirmatrix’s poor record keeping, NYX determined it would cost their company more to investigate the accounts than they would be able to collect.

‘This account is closed’

Despite these problems, the court allowed Confirmatrix to auction off what Boone described as a “subset of receivables” to First Portfolio Ventures, a Peachtree Corners debt collection company that paid pennies on the dollar for them.

Several people contacted by collectors working for First Portfolio have contacted Suwanee attorney Tom Kenney to look into the alleged debts. Kenney said he is still investigating, but he said the amounts sought don’t make sense for a typical urine screening.

“The cheapest one I’ve seen so far is $1,500,” he said. “They are just routine lab work.”

Even with federal investigators nosing around Confirmatrix’s business dealings, Kenney said he is not surprised a judge allowed the debts to be auctioned off. Federal bankruptcy court exists to provide protections for struggling businesses while looking after debts owed to creditors. There’s no one looking out for individual consumers, he said.

That leaves people like Michael Rowe to fend for themselves. Rowe, a Greensboro, Ga., resident, said calls from debt collectors got him worried about this credit rating so he paid up.

"I've got good credit and I didn't want to get that messed up. I was able to negotiate it to less than half of what they wanted," he said. "My doctor was beside herself."

Officials with First Portfolio referred comment to their lawyer, William Rountree, who reiterated that the sale of the accounts was approved by the court. The accounts were "pre-selected, reviewed and confirmed to be a valid unpaid payment obligation," Rountree wrote in an email to the AJC.

Boone, Confirmatrix’ attorney, had not been referring to the First Portfolio accounts when he told the court about Confirmatrix’s poor record-keeping and excessive billing, Rountree said.

Boone declined to answer the AJC’s follow-up questions, citing his client’s preference not to make public comments, but confirmed Rountree’s statement.

Carter, the Thomasville resident who had been contacted by First Portfolio’s collection agents, got a different answer when he called to inquire about his account. Carter said the conversation shifted when he told the representative he had been speaking with the AJC about the alleged debt and Confirmatrix’s legal troubles.

"They said, 'We can't talk to you anymore. This account is closed,'" he said. "I wanted to get something in writing, but they wouldn't even stay on the phone."

‘I don’t know what to tell our patients’

The debt collection efforts have jarred medical and psychiatric practices contacted by the AJC who used Confirmatrix to process urine specimens. Houston, Texas,-based Cornerstone Psychiatry Associates sent a letter in March to current and former patients explaining that in 2016 the practice hired Confirmatrix to perform in-house urine screening under an agreement that Confirmatrix “would file insurance for each test and that the patients would not be charged above what their insurance paid.”

“They assured our office that they would never send out patients to collections for outstanding balances and that they would write those balances off,” the letter states and urges patients to ask First Portfolio to cancel the debts.

Deborah Alvey, Cornerstone’s office manager, said the practice only used Confirmatrix for a short time and dropped them when they reneged on their promise to put their billing practices in writing.

“I don’t know what to tell our patients,” she said.

Khalid Satary, meanwhile, keeps a low profile. His name rarely appears on any official document.

Jordan Satary is easy to find. A recent graduate of Georgia State University’s Robinson College of Business, Jordan maintains an active social media presence across multiple platforms, including a long series of YouTube videos painting himself as an international entrepreneur. The videos detail his business philosophy and his travels, including a trip to the Great Wall of China while his companies went into bankruptcy.

Jordan Satary did not respond to messages seeking comment for this story.

About the Author

The Latest

Featured