‘Like a slush fund’: Revenue agents bought pricey perks with seized assets

Pricey gym equipment, commemorative Super Bowl badges, golf carts, $130 sunglasses — even stress balls shaped like beer mugs and wine bottles.

For years, a state revenue division has used millions of dollars from assets seized in criminal investigations to buy trinkets, travel, engraved firearms, tactical gear, a fleet of cars and personal items, an investigation by The Atlanta Journal-Constitution and Channel 2 Action News has found. The Office of Special Investigations at the Georgia Department of Revenue padded its budget rather than returning the money to the state treasury, the investigation found.

All of the spending came under the leadership of Joshua Waites, a former Clayton County Sheriff's deputy. Last week, Waites announced his resignation amid accusations that he falsified his resume, claiming a degree he never earned. But the department fired him March 11, two days before he was set to leave, after the AJC and Channel 2 asked questions about his spending.

Waites and his staff tore through forfeited cash under Waites’s leadership. By its own accounting, the Department of Revenue spent $2.9 million over the last four years leading up to his abrupt resignation, and is sitting on another $2.5 million in unspent funds.

“It’s unjustifiable,” said Rep. Scot Turner, R-Holly Springs, a legislative critic of civil asset forfeiture. “Trinkets? Souvenirs? For what purpose? It doesn’t help fight crime. It doesn’t help anyone get better at their job. It’s a trophy.”

The AJC and others have repeatedly highlighted how local and state agencies have abused forfeiture money, and the Legislature has made efforts to tighten the laws. The millions uncovered in the latest AJC/Channel 2 investigation come as Gov. Brian Kemp has asked state agencies to trim staff and freeze or cut budgets.

State Attorney General Chris Carr is researching if the revenue department broke state law by holding on to seized assets instead of returning the money to the general fund, where it might have been sent to help crime victims or fund indigent defense.

“Our office is aware and closely reviewing the matter,” Carr’s spokeswoman, Katie Byrd, said. The office is also continuing to work with the state Inspector General on its referral that Waites be subject to possible prosecution for falsifying his state application, she said.

Revenue Commissioner David Curry declined interview requests from the AJC and Channel 2, citing the ongoing investigation. Late Wednesday, the department issued a statement that said, in part:

“The Department is taking these concerning allegations very seriously and is fully cooperating with the (Inspector General’s) investigation. It is the Department’s goal to operate with integrity and transparency, and DOR is committed to making all necessary changes to ensure confidence in agency operations.”

Records show Waites’ office obtained the money now under investigation from criminal investigations — most of which appear to involve alleged illegal use of video gambling machines often found in convenience stores.

State law allows stores to have such machines, as long as winnings aren’t paid out in cash. When state and local authorities believe operators are breaking the law, they file criminal charges.

But they can also file a civil case against the owner of the store to seize their assets.

Oftentimes, owners of the stores agree to settle the cases, turning over their stores to authorities. The stores are then sold and the money from those sales is divided up among the Georgia Lottery, local district attorney’s offices, local law enforcement agencies and, sometimes, the state department of revenue.

Less clear is how revenue officials, who have the power to audit tax returns of Georgia taxpayers, monitored and approved the money that the department of special investigations spent.

In its statement to the AJC, the department said it was not even aware of some of the items purchased with forfeiture funds, and that officials would not have approved of them had they known. Some items remain unaccounted for, the statement said.

Dog food, machine guns — and stress balls

Receipts obtained by the AJC and Channel 2 show the special investigations office’s spending ranged from the merely curious to the outrageous.

In 2015 and 2016, nearly $5,000 in seized cash went to Petco for dog food, salmon jerky treats, canine toothbrushes and toys shaped like sumo wrestlers and boomboxes. The special investigations office does not enforce drugs laws, but records indicate it has a drug-sniffing dog.

In August 2018, the office went on a shopping spree at Staples and returned with wireless headphones, a microwave, a toaster oven, and a vacuum cleaner, as well as trashcans and staplers and other items often found in the state’s inventory of office supplies.

After last year’s Super Bowl at Mercedes-Benz Stadium, the department of revenue spent $9,539 in seized funds for commemorative law enforcement badges and special desktop frames to display them.

Nineteen of the 34 badges went to the department’s special agents, but included in the order was a badge for the former commissioner, Gov. Brian Kemp and the sheriff of Butts County.

In 2017, the revenue department spent $731,076 on 31 new vehicles, including a Ford F-350 Waites used as his personal car. The department has 22 take-home cars, 20 of which are assigned to sworn officers. In its Thursday statement, the department said Waites’ truck has been reassigned to another officer in his division.

The department is currently auditing its fleet of vehicles after a report of “potential misuse,” according to the statement.

In August 2015, the department spent almost $3,000 to purchase a Heckler & Koch MP5 submachine gun, equipped with a sound-suppressing barrel. The MP5 is popular with special forces and SWAT teams because of its compact size. Revenue officials said that gun is assigned to a state agent who is assigned to a federal drug task force.

Last spring, Waites’ office spent nearly $35,000 to purchase 43 new Glock 9 mm pistols, each with a LED handgun light, thigh holster and engraved with the revenue department logo.

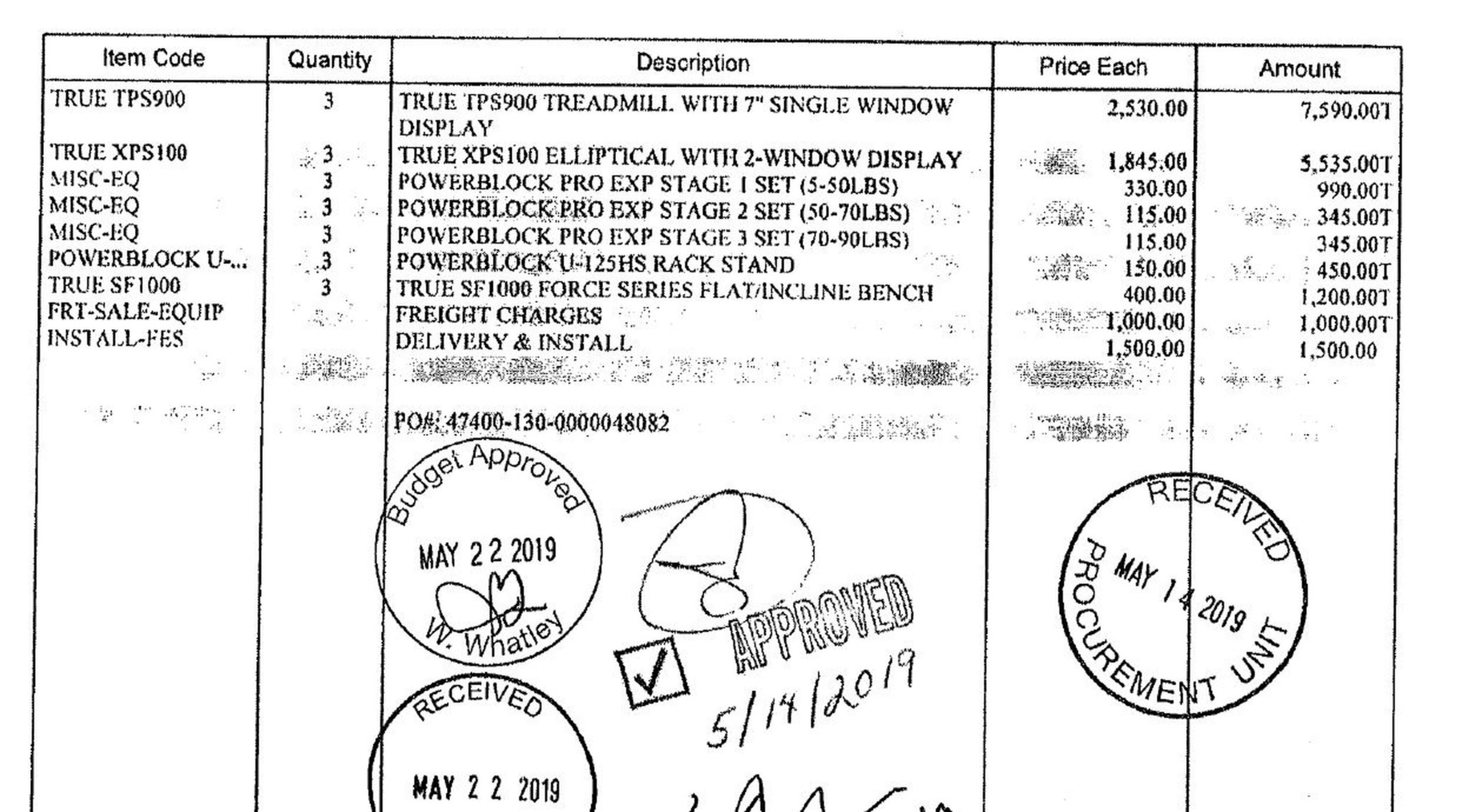

The list goes on. In May 2019, it was $19,000 in gym equipment — $2,500 of which was just delivery and installation charges. Also last year, the office bought 60 Fitbit fitness trackers for $6,660 and 300 specially printed stress balls shaped like beer mugs and wine bottles.

Those stress balls cost $759 and were given away at a training conference for department investigators last fall. In its statement, senior officials at revenue said they would have denied that purchase had they been aware of it.

“The department does not believe that these items are an appropriate representation of DOR and these items will not be purchased again,” the officials said.

‘Not a legitimate expense’

Still looming over Revenue’s Office of Special Investigations is a determination from the Attorney General if it was entitled to a share of civil forfeiture money in the first place.

State law says money seized by the state is “subject to appropriation from the general fund.” This seems to say that state forfeiture funds should first be deposited into the general fund and then be dispersed as determined by the General Assembly.

The Georgia Bureau of Investigation doesn’t keep the money it seizes as part of criminal investigations.

“Any state assets we recover we turn over to the general revenue fund,” GBI Director Vic Reynolds said. “It’s been our policy not to accept state funds.”

Holding on to cash and other assets would “cut out a key step” in government accountability, he said.

“The spending should be approved by a separate body, answerable to the public, like the Legislature,” Reynolds said.

Gwinnett County District Attorney Danny Porter, who has studied the state forfeiture law, said he believes state agencies are not entitled to receive shares of assets seized in state-initiated forfeitures.

“So it’s a moot point as to whether they are spending the money on legitimate law enforcement purposes,” Porter said. “They shouldn’t be spending the money at all.”

Porter said he is required to review annual asset forfeiture reports from agencies inside Gwinnett to make sure they are spending the money for approved law enforcement uses. If he finds improper expenditures, he can give the agency an amount of time to correct them. Or he can bar the agency from receiving state funds for up to two years.

When told that revenue had spent some of the forfeiture funds on Fitbits and exercise equipment, the DA said, “If I was looking at a local agency’s spending and saw that, I’d say that’s not a legitimate expense.”

In its statement, the revenue department said the Fitbits were purchased in 2018, under a prior administration, and “current department leadership cannot speak to the rationale of the purchase.”

“These devices are not currently accounted for; however, the department is actively working to rectify this issue,” the statement said.

‘Incentive for misuse and abuse’

The state’s forfeiture law also says it’s the intent of the General Assembly for the money to help fund the state’s indigent defense system; the Georgia Crime Victims Emergency Fund; law enforcement and prosecution agency programs; drug and mental health treatment; or the state’s judicial system.

According to annual disclosures required by law, the department of revenue has not shared any of its forfeiture collections with the indigent defense system, crime victims fund or the judiciary. It has only spent the funds on itself.

Sarah Totonchi, executive director of the Southern Center for Human Rights, said the state’s public defender system is chronically underfunded. A state office sitting on millions of dollars that could help fill that gap is stunning, she said.

“It is unconscionable to learn today of the existence of a massive pot of money that should have been dedicated to public defense but has instead been spent on frivolities,” she said. “It is imperative that our state leaders take action immediately to correct this irresponsible behavior and ensure that the public defense system receives the funds that it not only desperately needs, but is legally entitled to have.”

Former state legislator Wendell Willard, who once chaired the House Judiciary Committee, said he repeatedly tried to put more controls on the spending of state forfeiture funds. But fierce opposition from county sheriffs stifled those attempts, he said.

“There needs to be more oversight because it’s like a slush fund,” Willard said. “This money really needs to go to the general fund, where it can still be used for true law enforcement needs. But when you keep them in one agency, there’s too much incentive for misuse and abuse.”