The U.S. House Republican tax bill unveiled on Thursday provided some much-welcome news to boosters of Georgia’s troubled Vogtle nuclear project.

A provision nestled deep within the legislation would hand the project’s operators an estimated $800 million in tax credits — just one of thousands of tweaks to the country’s revenue code that could have a major impact on the ground in Georgia.

The proposed changes ranged from the large — lowering the corporate tax rate to 20 percent, something long sought by many of the state’s biggest companies — to the relatively small, such as ending the charitable deduction for people buying season tickets to college sports games.

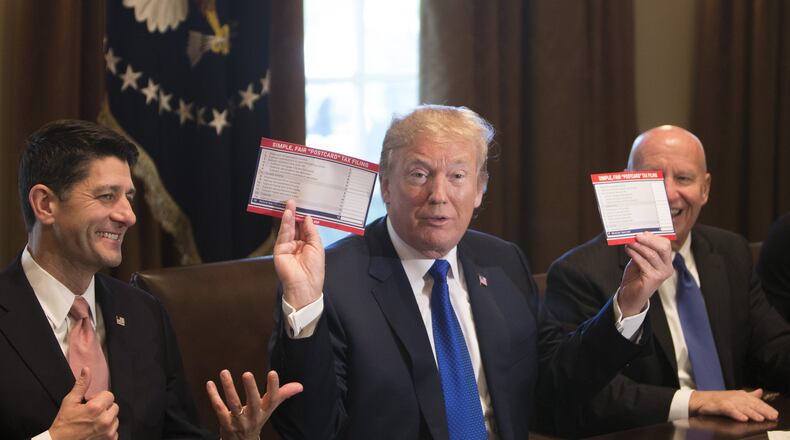

Local reaction to the plan, dubbed the Tax Cuts and Jobs Act, fell along predictable partisan lines.

Republicans said the overhaul would benefit people and businesses from every walk of life.

“The focus of the bill is across-the-board good for Georgia,” said U.S. Rep. Karen Handel, R-Roswell. “Those lower rates for families and hardworking men and women, the lower rates for small businesses, expanded child tax credit, being able to roll back and partially eliminate the death tax … all of those things are going to come together to accelerate growth … in a way that most of us have not seen in our lifetimes.”

Democrats were skeptical.

“It looks to be a giant giveaway to the wealthy,” said one of Handel’s Democratic colleagues, U.S. Rep. Hank Johnson of Lithonia. “It appears to be running over with red ink. I’m astounded by what could be a busting of the federal debt, but I reserve judgment until I see more analysis of it.”

Nuclear tax credits

Supporters of the nuclear project at Plant Vogtle were undoubtedly big winners on Thursday.

Members of Georgia’s congressional delegation had been pushing the authors of the tax plan to include the tweak, which would remove the 2020 sunset date for the previously promised nuclear tax credits.

Vogtle’s operators baked the $800 million worth of tax credits into the project’s bottom line, so extending the sunset date is considered critical for Vogtle’s financial future. The plant’s two new generators are not expected to come online before 2021 after its key contractor, Westinghouse Electric, declared bankruptcy in March.

The tweak to the federal nuclear tax credits exclusively benefits Vogtle since it’s the sole remaining new nuclear project under construction in the U.S., but it could benefit other projects should they enter development.

Georgia Power, one of Vogtle’s operators, indicated it was supportive of the provision in a statement Thursday, but the company danced around the issue of whether it approved of the tax overhaul more broadly.

“We continue to actively support legislation that would allow the Vogtle project to continue to qualify for advanced nuclear production tax credits if the units are placed in service after January 1, 2021,” the company said in a written statement.

Augusta-area Republican Congressman Rick Allen, whose 12th Congressional District is home to the Vogtle plant, said the provision’s inclusion is “great news for Georgia’s 12th District and for the future of nuclear energy in America.”

Vogtle is also on the receiving end of roughly $12 billion of federal loan guarantees, which in addition to the tax credits boosters say is critical to the project’s survival. Critics say the federal government is propping up an increasingly expensive and untenable project that will cost taxpayers if it fails.

Proposed eliminations

A few other under-the-radar proposed changes to the tax code could also have an impact on Georgians.

It would push through a change long sought by many religious groups by overturning the so-called Johnson Amendment, which bans tax-exempt churches from taking political stances and endorsing candidates.

“It’s imperative that we have that,” Handel said in an interview Thursday.

In a letter to the House's tax-writing committee last month, U.S. Rep. John Lewis, D-Atlanta, and dozens of other Democratic lawmakers warned against repealing the policy.

“Americans do not want our houses of worship, charitable nonprofits and foundations to become points of leverage for partisan politics,” the group wrote.

Meanwhile, the new tax bill would strike a popular tax break among University of Georgia and other college football fans, the charitable deduction afforded to people buying season tickets for college sports teams.

Another Republican proposal could affect Georgia’s larger private colleges and universities, including Berry, Emory and Spelman, by imposing a 1.4 percent tax on their endowments. Colleges and universities are currently exempt from such taxes because most are nonprofits.

Several of these institutions said Thursday that they were reviewing the proposed legislation.

In a letter to U.S. Sen. Johnny Isakson, R-Ga., on Tuesday, Emory President Claire Sterk raised concerns about the so-called endowment tax. Sterk said it would “severely undercut our ability to fulfill donor wishes and ensure the endowment’s longevity and integrity.”

Another proposed change would effectively eliminate the namesake federal program of the late Georgia U.S. Sen. Paul Coverdell as part of a broader consolidation of education savings account programs.

About the Author

Keep Reading

The Latest

Featured