Torpy at Large: The Atlanta Gulch question as a lesson in stressin’

There’s an old saying: “Those who can, do. Those who can’t, teach.”

I've been thinking about that since Tuesday, when opponents of the Big Tax Giveaway in the Gulch stood on the steps of Atlanta City Hall and trotted out the opinions of four learned professors who all thought badly of the deal.

The plan would pump nearly $2 billion (with a B!) of future taxes into the pockets of developers who want to build a gleaming Oz-like creation in the old railroad gulch downtown.

The profs come from four metro area universities and are experts in fields of learning such as regional planning, political science, economics and housing.

But while listening to their analyses and arguments, I started wondering about who I should listen to. The tweedy lecturers? Or the billionaires who construct lustrous towers?

Sure, the professors — from Georgia Tech, Georgia State University, Kennesaw State and Clark Atlanta — are all smart and studied. But they aren’t billionaire-smart. Billionaires are a cunning, even ruthless breed. They are wily enough to separate government officials from hundreds of millions of dollars in future taxes. And make them like it.

More so, they are able to get city officials to make it seem like the developers are doing them a favor and get them to perform much of the heavy lifting in the battle for the hearts and minds of Atlantans.

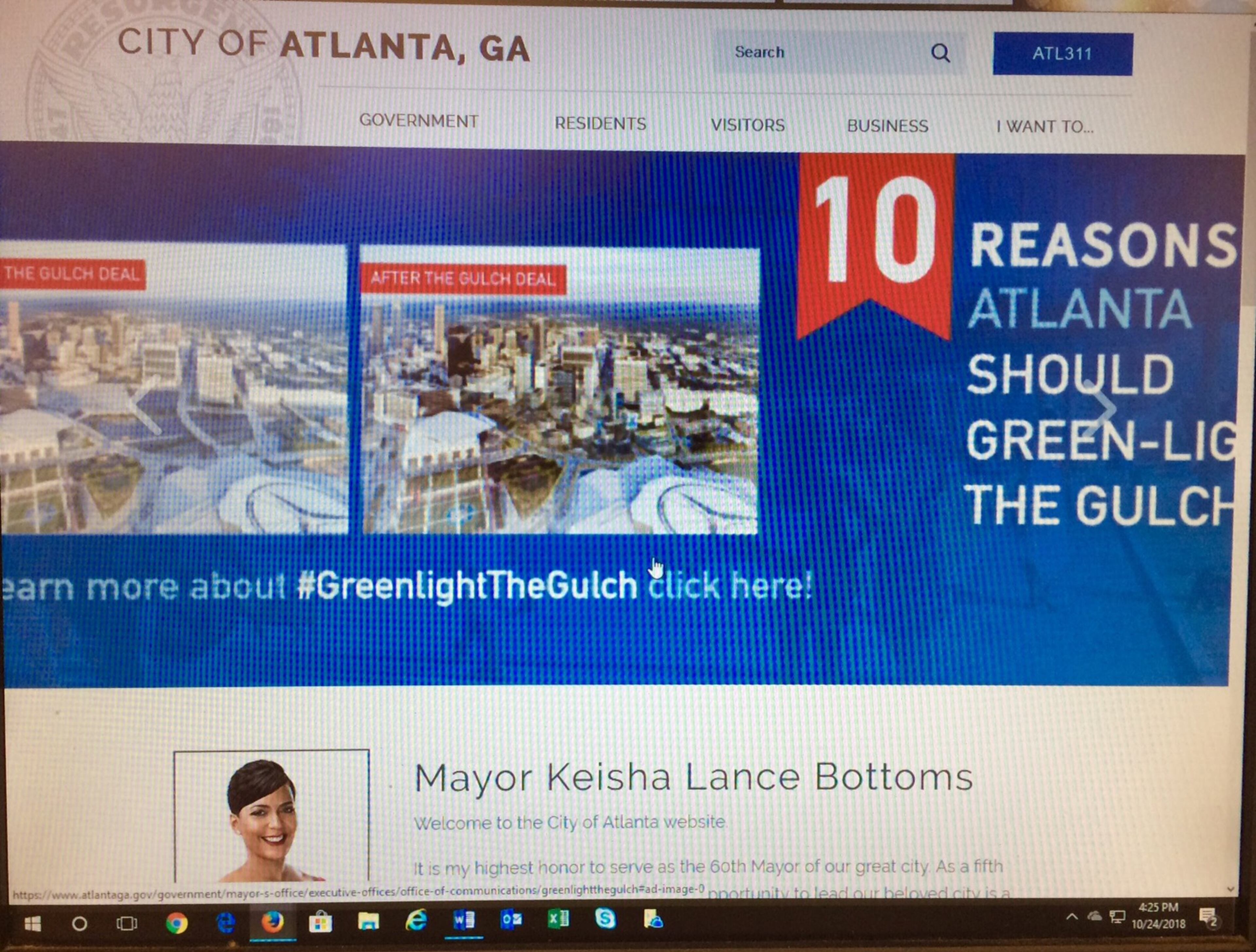

In fact, when you click the city's website, you'll see a smiling photo of Mayor Keisha Lance Bottoms under a large banner ad splashed across the top of the page urging the city (or more precisely her counterparts on the City Council) to "Green-Light the Gulch."

I suppose the professors don’t have it in them to engineer all of this. To their credit.

The Gulch project was cooked up by former Mayor Kasim Reed and the Los Angeles-based CIM Group, which is headed by the brother of the Atlanta Hawks’ owner (who previously got his own sweet arena deal from Hizzoner). It’s an audacious plan that was dropped in Bottoms’ lap when she came to office this year, and she has dutifully pushed it.

The original plan called for the city and state to forgo about $1.75 billion (again, with a B!) in future sales and property taxes in exchange for the CIM Group building $5 billion in offices, retail and apartments. The tax money, once generated, would be paid back to CIM, meaning 35 percent of the megalopolis would ultimately be paid for by taxpayers, except CIM would own every door handle and even the streets. The city would get about $55 million from CIM for affordable housing, a fire station and job training.

Proponents argue the Gulch is a 40-acre lot with nothing other than train tracks and parking lots and is not generating much in taxes. So what's the harm, they ask, of giving up 20 years of rising property taxes that could be generated there (an estimated $500 million) and 30 years of new sales taxes (an estimated $1.25 billion)?

Boosters — the Metro Atlanta Chamber, et al. — say the Gulch, probably the largest such tax subsidy in state history, will trigger all sorts of spinoff development, new jobs and other benefits. Opponents say it will pull development already coming to Atlanta into a place that will not generate taxes for decades. It’s called cannibalization.

Professor J.C. Bradbury, an economist from Kennesaw State, said the city and developers are employing “rosy projections that are wishful thinking. These are black box numbers.”

Bradbury pointed out that the developers must prop up the new streets and buildings at a cost of $500 million. That’s why no one has built there for a century. And that’s why such a huge subsidy is needed.

“Why does it have to be at this place?” he asked. “It’s not like we’ve run out of places in Atlanta to develop.”

As Bradbury finished his remarks outside City Hall, Mayor Bottoms released a perfectly timed letter touting a new proposal.

“The newly negotiated agreements reflect a dramatic decrease in the Tax Allocation Bond portion from $625 million to $40 million,” she wrote, adding that the new plan was a “pay-as-you go plan.”

Many members of the media, who mostly are not as good with numbers as professors or billionaires, immediately bought what the mayor was selling and reported the new plan as a “dramatic decrease!”

While technically true, the mayor’s letter was not telling the full, unvarnished truth.

Actually, there will be a big drop in the bonds that will be issued, but CIM will still get a steady stream of reimbursements from property taxes that will not be going to the city and to schools. In fact, the cost of the plan will jump to a potential $1.9 billion subsidy, as my AJC colleague Scott Trubey correctly reported.

And $125 million in bond funding that would have gone to the surrounding Westside neighborhood will be cut to about $8 million.

Oops.

The mayor has called for the council to vote a couple of times but has backed off after seeing the eight votes needed to pass this scheme were not there. A vote could happen on Nov. 5.

Councilman Michael Julian Bond, who would live in the shadow of the buildings that might rise from the Gulch, said the drop in bond funding for the surrounding neighborhood “is kind of a letdown for those communities.” Still, he said the new plan is more palatable.

I mentioned that taxpayers would be footing almost 40 percent of the development.

“That’s what the state law allows,” he said. “If someone is willing to invest in a No Man’s Land, can we suddenly turn around and say, ‘No, you can’t get this benefit?’ It’s almost a circular argument.”

And for the next few weeks, it seems like the city will continue chasing its tail.