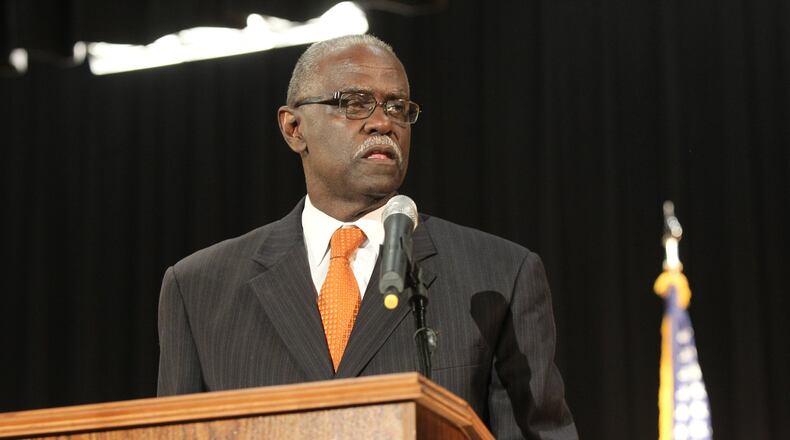

Bill Edwards, mayor of the new city of South Fulton, just wants to give Arthur Ferdinand some of his city’s money.

Ferdinand, the Fulton County tax commissioner, is willing to take it.

Fulton County commissioners are standing in the way.

“I’m so mad, I don’t know what to do,” Edwards said, hours after commissioners voted Wednesday not to allow a contract between Ferdinand and the city to collect the city’s taxes. That agreement would have enhanced Ferdinand’s salary by $1 for every parcel he collected taxes on. There are 40,596 taxable parcels in the city of South Fulton.

Ferdinand, who is the highest-paid elected official in the state, collects a similar per-parcel fee in the three other Fulton cities where he collects taxes: Atlanta, Johns Creek and Sandy Springs. Altogether, the fees netted him an additional $210,281 last year. His total salary was about $390,000.

State law allows the fees from cities that have contracts with their county’s tax commissioners. It says the tax commissioner can accept additional compensation for taking on more duties — like city tax collection. But the money has to pass through the county.

And Fulton isn’t on board.

“I think it’s wrong the money would go to his salary vs. going to the department that’s actually doing the work,” Fulton County Commissioner Liz Hausmann said. “It’s troublesome.”

A 2007 law tried to curb the practice, but existing contracts were grandfathered in. The new South Fulton contract is subject to the fee only if Fulton agrees to it. Edwards doesn’t think that’s fair.

“I was floored today that they didn’t pass this thing,” he said on Wednesday. “It’s our call. If we want the man to do our taxes, what have you got to do with it?”

Kevin Payne, the Floyd County tax commissioner and president of the Georgia Association of Tax Officials, said it’s not uncommon for tax commissioners to have contracts that pay them $1 per parcel for their work. His does. So does Irvin Johnson’s in DeKalb County. Gwinnett’s tax commissioner collects for cities but does not collect the fee. Cobb does not collect tax revenue for cities.

In areas where the fee exists, it’s a remnant of a time when constitutional officers made their income through fees and fines.

“It’s a fairly common practice,” Payne said of the fee.

The high number of taxable parcels in Fulton County puts a spotlight on Ferdinand.

The fee may add to the cost of tax collection, but Payne said it’s far less than it would cost for each city to collect taxes on its own, and the process is more efficient.

Jeff Breslau, a Johns Creek spokesman, said the city uses Ferdinand to keep residents from getting two tax bills. Jenna Garland, an Atlanta spokeswoman, said the city partnered with Ferdinand in 2002 after trying to collect on its own. Before then, she said, the collection rate fell below 90 percent. And the fees for collection are less than it would cost to reestablish that office.

Ferdinand could not be reached for comment on Friday. But he said Wednesday that he was not willing to negotiate the $1 per parcel fee.

"I am open to the law, and the law says I will be compensated," he said.

Hausmann said she hopes Ferdinand will reevaluate his position. The matter will again come before the board Aug. 2.

In South Fulton, Edwards is worried that he’ll have to contract with someone else if commissioners don’t approve the agreement. Right now, no taxes are being collected in the city.

"Dr. Ferdinand ain't doing nothing illegal, he's doing something you don't like," said Edwards, a former Fulton County commissioner. "He takes advantage of it. …The state of Georgia thinks it's fine."

MYAJC.COM: REAL JOURNALISM. REAL LOCAL IMPACT.

The AJC's Arielle Kass keeps you updated on the latest happenings in Fulton County government and politics. You'll find more on myAJC.com, including these stories:

Never miss a minute of what's happening in Fulton politics. Subscribe to myAJC.com.

About the Author

Keep Reading

The Latest

Featured