Gwinnett residents could pay an extra $100 yearly for MARTA expansion

Gwinnett County voters will decide March 19 whether they’ll pay an extra 1 percent sales tax to fund MARTA’s expansion into their county. But how much does that extra penny per dollar spent add up to for each person?

Instead of an annual bill, Gwinnett County residents and anyone else spending money in the county’s borders will pay for expanded transit services through nearly every purchase made in the county. Paying for transit needs with a T-SPLOST (transportation special purpose local option sales tax) model is one that Fulton and DeKalb counties have also used to fund MARTA.

The tax is often referred to as a “penny tax” because it adds an extra penny per dollar to taxed purchases. But for consumers, the pennies can add up.

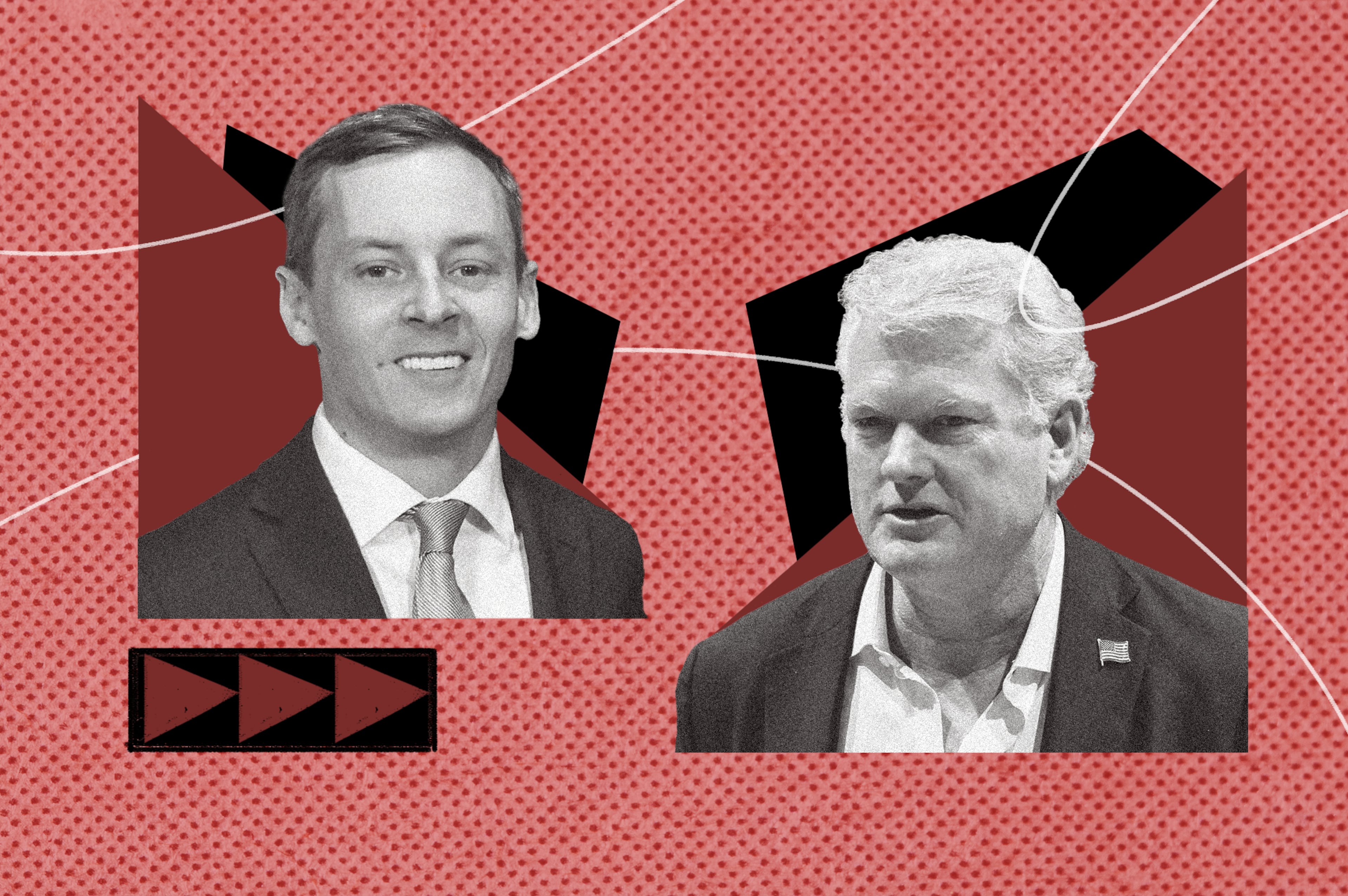

LISTEN | Podcast: Understanding Gwinnett County's upcoming MARTA vote

READ | Gwinnett's MARTA referendum: a comprehensive voter's guide

According to one Georgia State University economist, the annual cost to a county resident is about $112 per year. Peter Bluestone researched the annual cost of a T-SPLOST for metro Atlanta residents in 2012. While the overall average was $112 per person, lower-income people were found to have annual costs as low as $76. Those who made $70,000 per year or more had an average cost of $142 per year. Those with higher incomes tend to make more purchases and thus pay more in income tax.

Because the study was conducted seven years ago, the true average may have risen with inflation and increases in income, Bluestone said. But because most consumers don’t track what they pay in sales tax, the increase may not be noticeable for most.

“Sales tax is not very salient, the reason being it’s taken out every time we go to the store,” Bluestone said. “One of the more salient taxes is property tax. People see a bill or statement of how much they owe every year, whether they pay it out of pocket or through their mortgage. People are very aware of how much they pay in property tax, but not sales tax.”

County research in preparation for a transit expansion effort reflected this difference, spokesman Joe Sorenson said. Gwinnett County residents responded much more favorably to the option of a sales tax than that of a property tax in surveys.

RELATE | Gwinnett and MARTA: Clearing up frequently asked financial questions

READ | Gwinnett's MARTA ballot question doesn't mention MARTA — or taxes

MORE | Where do Gwinnett's political leaders land on MARTA? It's complicated

But if the referendum passes, the tax is nearly unavoidable for almost anyone shopping in Gwinnett, whether they take advantage of future MARTA buses and trains or not, said Tom Smith, an associate professor of finance at Emory University.

“It’s not just one cent. These taxes are one cent on everything,” Smith said. “There’s nothing you can do about it; you can’t not buy goods and services.”

Sales tax is considered “regressive” by economists, meaning it has a more significant impact on low income people than those with high incomes. While an extra $112 might not register as much of a loss over the course of a year for some, those on the lower end of the income spectrum are more likely to notice the extra money they’re spending, Smith said.

“There’s a fairly sizable percentage of people for whom every dollar matters, whether you’re officially at or below the poverty line or earning $50,000 a year,” Smith said. “Someone earning $50,000 a year could still be very aware of their income and spending.”

Gwinnett residents won’t bear the full burden of the tax, as anyone who makes a purchase in the county is subject to county sales tax. Between 25 and 30 percent of Gwinnett’s sales tax revenue comes from non-residents, according to a pro-transit advocacy group. Go Gwinnett spokeswoman Paige Havens said that the number was not a new calculation, but one previously used in other SPLOST campaigns.

The non-resident contributions also helped make the sales tax more appealing to residents than property tax, Sorenson said.

“A property tax falls squarely on the property owners in a jurisdiction, while with sales tax, you get help with people from other jurisdictions,” Sorenson said.

Some Gwinnett residents, like Lilburn’s Wilma Simons, are fine with paying a little more to have wider access to public transportation. Simons commutes to Atlanta every day, and it’s common for her to spend 60 to 90 minutes in the car each way. She is planning on voting “yes” on the referendum.

“We definitely need to do anything we can to improve transportation in this area,” Simons said.

But for some who won’t utilize an expanded transportation system, an extra 1 percent tax could be irksome, Smith said. Smith does not live in Gwinnett County, but commutes to Emory from outside the Perimeter by car.

“People who don’t use public transportation would say, ‘Why don’t you increase the cost of a train ticket or a bus ticket?’ Because then the people using it are taxed, and the people who aren’t aren’t taxed,” Smith said. “That’s a very common way of thinking about tax burden … It’s important to understand that there are people who might want the burden to be put on those who actually use the good or service.”

Staff writer Tyler Estep contributed to this report.

WHEN AND HOW TO VOTE

Election Day in Gwinnett County is on March 19, but there are also about three weeks of advance in-person voting.

Advance voting begins Feb. 25 and lasts until March 15. Voting will occur daily, including Saturdays and Sundays. Ballots can be cast at the county elections office at 455 Grayson Highway in Lawrenceville 7 a.m. to 7 p.m. daily. Voters can also pick up mail-in absentee ballots at that location.

There will also be satellite locations where you can vote 7 a.m. to 7 p.m. March 4 and March 15:

Bogan Park Community Recreation Center, 2723 North Bogan Road, Buford, GA 30518

Dacula Park Activity Building , 2735 Old Auburn Road, Dacula, GA 30019

George Pierce Park Community Recreation Center, 55 Buford Highway, Suwanee, GA 30024

Lenora Park Activity Room, 4515 Lenora Church Road, Snellville, GA 30078

Lucky Shoals Park Community Recreation Center, 4651 Britt Road, Norcross, GA 30093

Mountain Park Activity Building, 1063 Rockbridge Road, Stone Mountain, GA 30087

Shorty Howell Park Community Recreation Center, 2750 Pleasant Hill Road, Duluth, GA 30096

AJC’s COMPLETE COVERAGE

Gwinnett voters will go the polls on March 19 in a historic special election that could change the face of metro Atlanta’s suburbs.

Residents there will decide if Georgia’s second most populous county will join the MARTA system and chip in a new 1 percent sales tax to pay for billions of dollars in transit improvements. A successful referendum in Gwinnett may ignite action for more mass transit in other metro Atlanta counties that have long been resistant to the idea.

The Atlanta Journal-Constitution will provide comprehensive coverage leading up to the vote and on Election Day. Our reporters will help readers understand the issues, the key players, what’s at stake, and provide information for voters to make an informed decision at the ballot box.

Like Gwinnett County News on Facebook | Follow us on Twitter and Instagram

Stay up to the minute with breaking news on Channel 2 Action News This Morning