Tuesday marks the beginning of what can be the toughest part of applying for college, filling out the Free Application for Federal Student Aid.

Students have said the application is complicated and time-consuming. Some parents don’t understand how it works.

“This is very confusing and it’s just that thing that you put off because you know it’s not going to be easy,” said Kristin Boyer, a DeKalb County mother. “The whole process of college application is overwhelming.”

Federal education officials have tried to streamline the process in recent years, particularly by finding the best way to connect with students. In 2018, they created an app for that. Before that, they changed the timeline for applications so that parents no longer had to rush to complete their tax returns.

Parents, counselors, lawmakers and financial aid experts say the enhancements have helped, but there are some necessary tweaks that still need to be done, such as figuring out what tax information is necessary to fill out the form and how to fix errors.

Federal financial aid is often the largest resource for students headed to college. It can supply Pell Grants, which are $6,095 this school year, and low-interest loans. The Federal Student Aid Office provided more than $122 billion in grants, loans and work-study funds to an estimated 12.7 million students during a recent 12-month stretch, according to its annual report released in November.

Federal officials hoped the app would change the feelings of dread some parents have before filling out the form. About 10% of students used the mobile app, the National College Access Network’s MorraLee Keller has heard. That’s twice what she anticipated.

U.S. Education Secretary Betsy DeVos has promoted it in visits across the nation, including a November 2017 stop at Georgia State University and an October 2018 trip to Georgia Tech. She said the time it takes students to apply for aid has been cut from about 90 minutes to 32 minutes.

That sounds about right to Nancy Halloran, an independent college consultant in Brookhaven.

“For first-time parents, it all seems really overwhelming,” said Halloran, of May First College Consulting. Since federal aid runs out, it’s first-come, first-served, which adds to the stress. However, the changes to the process enacted in 2017 have made applying far easier, she said. That’s when the start date for applying was rolled back to Oct. 1, instead of January. Perhaps more importantly, parents could now use their prior year tax return, instead of scrambling to get the current year return in early.

Some parents are frightened by questions, such as what’s the expected family contribution, said Tara Wessel Swoboda, senior director of Collegewise, a California-based counseling organization. She encourages parents to collect documents needed to fill out the form early to avoid stress and mistakes.

>> RELATED | How to win at negotiating college financial aid

The new form automatically links parents’ IRS filings, so most of the information flows through with the click of a button. Parents and students still must add details, such as current checking and savings account balances, but if they’ve gathered the key documents, such as the prior year tax return, the process is relatively painless, Halloran said.

“If you have that, it really should take no more than 30 to 45 minutes,” she said. “It can go smoothly if you prepare for it.”

Parents still make mistakes, though, and they can be difficult to rectify.

That is because, technically, it’s the students who are supposed to be in charge. They have their own logons and passwords. (Halloran recommends applying for these as soon as possible, since it can take several days for the system to link FAFSA accounts to IRS accounts and Social Security numbers.)

When mistakes happen, parents and students have to match busy calendars, so they can make the fixes together.

Stuart Sheldon of Buckhead said he’s made errors a couple of times, once for a son who was still in high school and once for a son in college (the form must be updated annually). It was difficult finding time to get together, he said. Worse, there were the dreaded forgotten passwords.

“I can’t tell you how many times we had to get passwords reset,” Sheldon said, adding that it’s not as easy as resetting the Netflix account.

>> READ | FAFSA filing season begins Oct. 1: What does this mean for students?

Even so, Sheldon said the process is markedly better than it used to be. He was able to basically turn his first son into a template for his younger two, making it relatively easy to add them. He filed for his first son before the improvements in 2017.

“Remember, it used to be even worse,” he said. “I had it much harder than you will.”

Shirley Caldwell of DeKalb County had the same experience. She sent her son off to college several years ago, and had to fill out the FAFSA for her daughter last year.

“When I logged in to do my daughter, it asked if I had another student, and just filled everything out,” she said, adding that it took maybe half an hour.

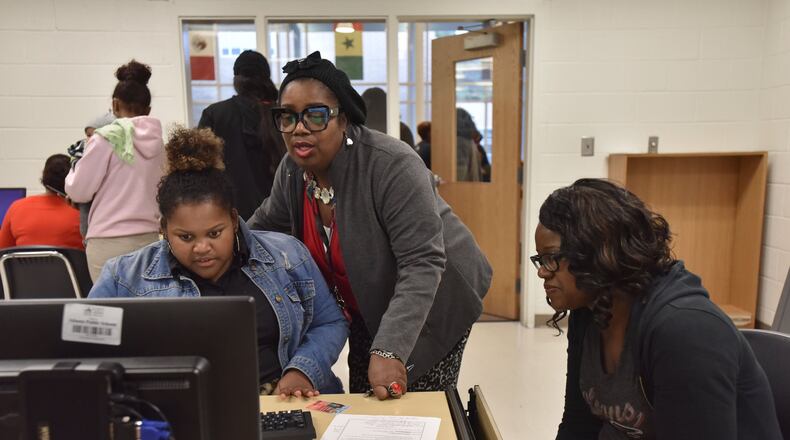

Credit: HYOSUB SHIN / AJC

Credit: HYOSUB SHIN / AJC

About 57% of last year’s high school seniors filled out the FAFSA, according to the National College Access Network. Georgia ranked 25th nationally, at about 56%, the network’s data shows.

Louisiana is the only state that requires all public school students to fill out the FAFSA before graduating from high school, unless they get a waiver. Illinois and Texas passed similar laws this year.

Georgia congresswoman Lucy McBath earlier this month co-sponsored a resolution to make it easier for low-income students to fill out the FAFSA by allowing them to bypass some financial information requested on the application.

“Students and their families spend long hours navigating the over-complicated financial aid process. The HOPE for FAFSA Act will simplify that system and make it easier for our kids to get the financial aid they need,” the Democrat from north metro Atlanta said in a statement.

But complexity may not be the only reason many avoid the form.

Tom Maiellaro of Buckhead knew financial aid was distributed on a first-come, first-served basis, so he was eagerly clicking the send button at 5 a.m. on Oct. 1 when he filled out the form for his oldest son. The reward for his efforts: a “pittance,” he said.

Once complete, the form indicates how much money parents can afford to pay. Maiellaro thought the number was ridiculous. “I looked at my wife and said, ‘We’re not getting anything.’ ”

Parents should still fill it out, he advised. As with Christmas, though, it’s probably best to imagine a fruitcake in that pretty box.

“Just go into it with an open mind, but you’re probably not going to get anything.”

FAQ

What information is needed for the FAFSA?

- A few days before filling it out, go to the website and apply for FAFSA IDs for yourself and your child (only one parent gets an account). Once the accounts are linked to Social Security and IRS data, the information will auto fill when you're ready to fill out the form. You'll need the Social Security numbers for parent and child and the prior year tax return. The website typically bogs down in the first week of October. — Nancy Halloran, consultant

- Gather information about assets, such as checking and savings account balances, and investments. If you have an accountant or financial planner, they can probably provide a list of the necessary documents. — Tom Maiellaro, parent

Why bother filling it out?

- The results will indicate how much parents can "afford" to pay for their child's education. Middle-class students typically don't qualify for grants, but they can get government-subsidized (low-interest) loans, maybe enough to help with room and board. — Maiellaro

- The form must be refiled annually. If you pass on filling it out initially, you typically can't change your mind later in the child's college career, which can pose problems if there's a life-changing event, such as the loss of a job, that would increase financial aid eligibility. Halloran

What are the deadlines?

- The last moment to submit the form is June 30 at 11:59 p.m. Central Time. — U.S. Department of Education's Federal Student Aid Office

- But the federal grants are limited and distributed on a first-come, first-served basis, so don't procrastinate. The application period starts Oct. 1. Try to get it done in October. — Halloran, and parents Maiellaro and Shirley Caldwell

What happens next?

- Colleges and universities will use the information to craft financial aid packages, which they can distribute prior to June 30, hence the urgency. The money could be gone for late applicants by then. "If those school dollars are federal dollars, eventually they do run out. … You don't want to be at the back of the line." — Halloran

What else?

- Do not lose your password. Changing it is "a huge pain." — Halloran

- Fill out the worksheets beforehand. "They're super helpful." — Tara Wessel Swoboda, senior director of Collegewise

- Those targeting many private schools and elite institutions will also have to fill out the College Scholarship Service Profile. It demands far more detail than the FAFSA, inquiring about home equity and other assets, though in both cases retirement accounts are off-limits. "If you want to go to Princeton, they're going to know if you have a yacht." — Halloran

- The FAFSA is blind to assets like cars. So if you've been saving up for one, the time to buy it is before, not after, filling out the form. — Halloran

- The student has the main account. His or her password is needed to fill out most of the form. That means he or she will have access to parents' financial information. Some parents are uncomfortable with that. One parent threatened to complain to a high authority. "I think they said they were going to call their congressman because they didn't think their kid should have access to that information." — Stuart Sheldon, parent

- The child is technically in charge. They can learn a real-world lesson by filling it out. "Welcome to adult life, kid. It doesn't get any easier." — Halloran

- Some debate whether parents should fill it out instead, since money is on the line and the odds of error may rise if the child is driving the process. They're busy with academics, extracurricular activities and college applications and essays: "Their head's probably spinning a mile a minute." — Sheldon

Keep Reading

The Latest

Featured