Georgia’s new ACA health insurance signups gain speed, still problematic for some

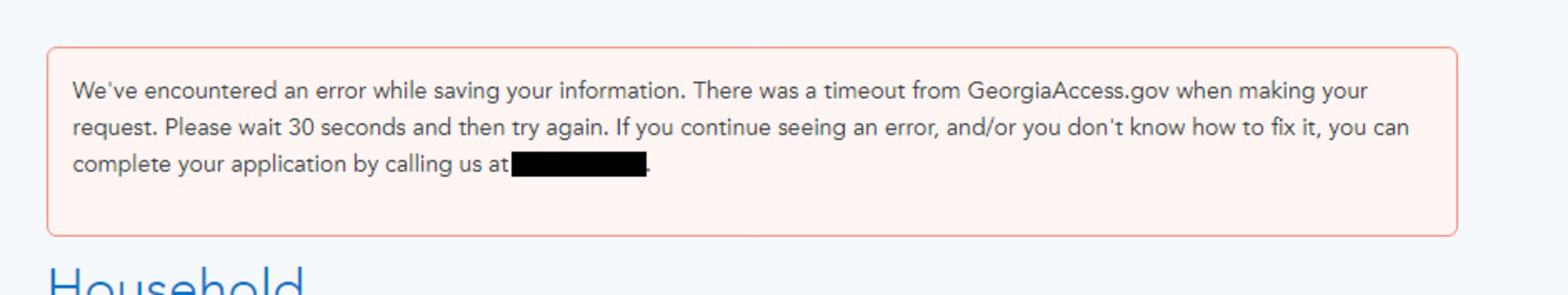

More than three weeks after Georgia launched its state-based Affordable Care Act health insurance shopping website, GeorgiaAccess.gov, Americus insurance agent Kirk Lyman-Barner was still getting error messages. The computer screen would pause for a “timeout” and suggest a phone number to call if he wanted to resolve it immediately. But the number it gave him was his own number.

On Nov. 1, Georgia launched GeorgiaAccess.gov, the state’s own version of the decade-old federal ACA website, healthcare.gov. Healthcare.gov is now blocked for Georgia shoppers, and it transferred all the existing policy accounts over to Georgia Access.

About 62,000 Georgians have used the new computer system to enroll as of last week, according to the state. Some like Lyman-Barner use it through a web broker computer system that is connected to Georgia Access.

Several Georgia Access users reported significant computer problems on the day it opened, and they say it has improved. But some are still running into problems.

The state Office of the Commissioner of Insurance John King said in a written statement that “While a very small number of users faced some technical difficulties during the first week of Open Enrollment, our team has worked diligently to overcome these barriers and ensure every Georgian has access to quality, affordable health coverage.” The office’s spokesperson, Bryce Rawson, said issues “have, and continue to be, swiftly and promptly resolved.”

“The number and type of technical difficulties for a project of this size, scope, and nature fall well within our expectations,” Rawson said.

“Every state exchange transition has growing pains and Georgia is doing something new” partnering with web broker sites that can also serve as a front for GeorgiaAccess.gov, said Emily Duffee, a spokesperson for the web broker HealthSherpa. Georgia is doing all that, she said, “while supporting three times the volume of any other recent Exchange transition. We’ve seen applications more than double since the rocky first weeks.”

Not actually incarcerated

For Lyman-Barner’s office, some problems are minor: Occasionally they find they can’t reenroll a 2024 client for 2025 because the computer has incorrectly changed their status to incarcerated, or not an American citizen. In those cases they just correct the account information.

But he says one major issue remains unresolved: he is the office’s only fully licensed agent, and his three co-workers are “sub-agents,” trained and qualified by the state. But when they went to start enrolling people this year, they were blocked. It turns out that this year the state does not allow sub-agents to each use the exchange on their own, but the state never told his office ahead of time, he says. Now it’s too late for this open enrollment season to get his sub-agents trained and licensed to work within the exchange, which means they can’t help shoppers buy plans unless he’s involved.

He said he’s hopeful the issue will eventually be resolved, but in the meantime he feels caught between his web broker and the state’s computer systems pointing fingers at each other.

The delays mean his office’s commission revenue is down more than $40,000 compared to the same time last year. He says that’s the equivalent of one annual salary in his office.

Another shopper who also spoke to The Atlanta Journal-Constitution about his difficulties on the first day of open enrollment, Brent Feinberg, later said he was finally able to enroll.

About 1.3 million Georgians are enrolled in ACA plans. If they do nothing before reenrollment ends on Jan. 15, the state has said it will automatically reenroll them in the most similar type of plan for 2025.

Why Georgia Access?

A major upside of leaving healthcare.gov for a state-based exchange website is that Georgia now collects the user fees that go to whoever runs the insurance shopping website. That adds up to hundreds of millions of dollars that the state is allowed to put toward its “reinsurance” program that lowers premiums for middle- and upper-income ACA policyholders.

It’s part of a yearslong health insurance effort by Gov. Brian Kemp to stitch together state-tailored programs for ACA health insurance and Pathways to Coverage, a state Medicaid program for some poor adults.

One expert said not to rush to judgment either way.

For one thing, any startup exchange will have growing pains, said Sabrina Corlette, co-director of Georgetown University’s Center on Health Insurance Reforms.

For another, enrollment’s biggest rush comes late in the season — typically in mid-December. In addition, she said, this year’s election noise in the first week of open enrollment may have distracted people.

“I would just say let’s not draw any conclusions just yet,” Corlette said.

How to get help enrolling in GeorgiaAccess.gov

For shoppers to get help using GeorgiaAccess.gov, the Office of the Commissioner of Insurance gives the two support phone numbers below. They say 95% of users who call have their issue resolved on the first call.

- Consumers who continue to have technical difficulties should call our consumer support line at 1-888-687-1503 (TTY Line 711 for those who are hearing impaired)

- Partners who continue to have technical difficulties should call our partner support line at 1-888-312-4237 (TTY Line 711)

Source: Georgia Office of the Commissioner of Insurance