The day before he disappeared, Christopher Burns finalized a divorce agreement, transferring many of his assets to his wife. Then he took off from their million-dollar Berkeley Lake home.

That next day, he transferred hundreds of thousands of dollars from his corporate accounts to his personal checking. But his trail went cold from there. The only trace of his movements was his vehicle, found abandoned in a parking lot on Perimeter Center East in Dunwoody.

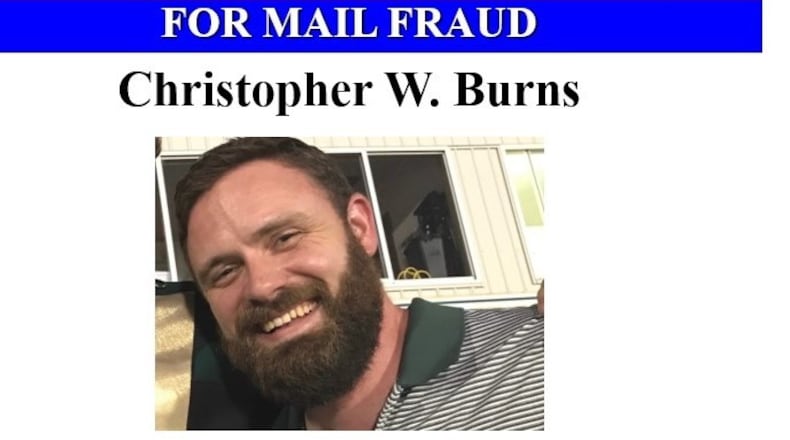

The once-prominent investment adviser soon landed on the FBI’s Most Wanted list, accused of bilking his clients out of millions of dollars. The day he vanished — Sept. 25, 2020 — was the day he was supposed to turn over documents about his dealings to regulators at the federal Securities and Exchange Commission.

Now, a federal court has entered a default judgment in the SEC’s lawsuit against Burns and his companies: Investus Advisers LLC, which did business as Dynamic Money; Investus Financial LLC; and Peer Connect LLC.

They must pay more than $12 million, Judge William M. Ray II recently ruled. And Burns, if he is ever found, is also liable for a civil penalty of $652,629.

It’s unclear, though, how much, if anything, Burns’ victims will ever see. Federal court documents indicate that there was some money in various bank accounts for his businesses, frozen by court order after his disappearance. And Burns’ ex-wife previously agreed to disgorge $320,000 in funds he had transferred to her.

But federal officials say most of the investors’ money was spent to fund Burns’ lifestyle, pay business expenses and repay earlier investors, to create the appearance that investments he sold were profitable.

The SEC declined comment. Attorneys representing investors in a separate lawsuit did not respond to a request for comment.

Burns, who claimed to be an investment guru, had a high profile in the Atlanta metro area. He purchased air time for a weekly radio program, the Chris Burns Show, and appeared on TV offering financial advice.

But according to the SEC’s suit, for years he sold fraudulent promissory notes to more than 90 investors in Georgia, North Carolina and Florida.

The notes, he claimed, were for a “peer to peer” lending program, where businesses in need of capital would borrow money. In return, Burns told investors that businesses would repay the principal plus interest as high as 20%. He also told clients the investment had little or no risk because the loans were collateralized dollar for dollar by investment securities put up by the businesses.

Federal officials, though, say the lending program was a sham.

Credit: Screen grab

Credit: Screen grab

As the SEC closed in on the scheme, Burns became even more brazen in his dealing with investors, according to court documents. On Sept. 9, 2020, he received checks totaling $142,500 from two investors. A few days later, he wired $35,000 to one of his personal bank accounts and spent another $15,000 on personal expenses. The remaining funds went to pay other investors and business expenses, the government says.

And the day before his disappearance, Burns posted a video on Twitter, recommending that people take a “holistic” approach to savings.

Still pending against Burns is a federal criminal complaint, charging him with mail fraud. There’s been no action in that case since Oct. 23, 2020, when the complaint was filed.

Burns is 39 years old. The FBI notes that he has a tattoo on his left forearm of three black, interlaced triangles. He is 6′2″ and when last seen weighed about 240 pounds.

Finding Christopher Burns

The FBI asks that if you have information about Christopher Burns’ location, or you think you were defrauded by the investment adviser, you can contact agents at (770) 216-3000 or visit tips.fbi.gov.

About the Author

Keep Reading

The Latest

Featured