A scheme led by two Atlanta-area men allowed investors to claim more than $1 billion in false federal tax deductions. Now, both men are heading to federal prison in a case that sounds a warning to others involved in what’s been called a shady tax dodge for the wealthy.

Chief U.S. District Judge Timothy Batten on Tuesday sentenced Jack Fisher, of Alpharetta, to 25 years, and James Sinnott, of Suwanee, to 23 years. The judge also ordered them to pay restitution of about half a billion dollars.

“It shocks the conscience, the degree of fraud in this case...,” Batten said in sentencing Fisher, adding later, “At the core of this is a level of greed that is sinister.”

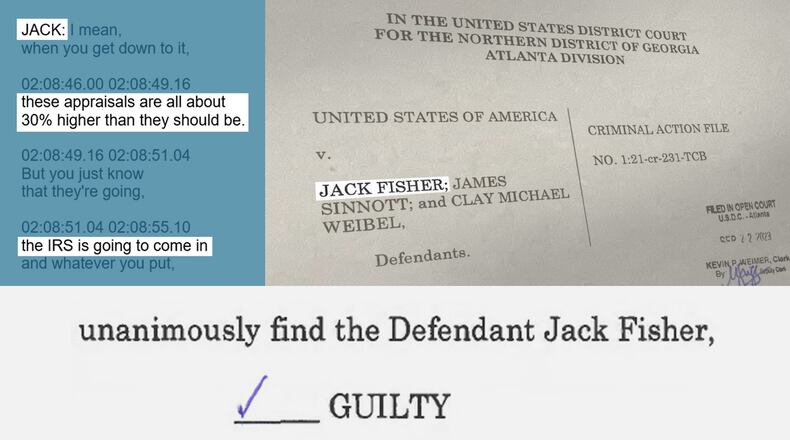

Fisher, 71, and Sinnott, 52, were convicted in September in the nation’s first criminal trial involving a tax shelter known as syndicated conservation easements. The jury found them guilty of conspiracy to defraud the United States, wire fraud conspiracy, aiding and assisting the filing of false tax returns, and subscribing to false tax returns.

Also on Tuesday, two other Atlanta-area men charged in connection with the scheme pleaded guilty in separate hearings in Batten’s courtroom. CPAs Victor Smith and William Tomasello admitted to conspiracy to defraud the United States. They are scheduled to be sentenced in April.

At least six other defendants have previously pleaded guilty to criminal conduct related to the scheme, in cases out of Georgia, North Carolina, New Jersey and Florida, and trial is pending for at least one other defendant in Georgia.

Conservation easements are tax deductions given to landowners who agree to permanently limit uses of environmentally sensitive land. But Georgia became the epicenter of what the government called a fraudulent use of the deductions. Various promoters told high-income taxpayers that by buying into an easement, they could get charitable tax deductions worth several times what they paid in.

To ensure that, syndicators hired appraisers to generate what the government has called grossly inflated appraisals of land values based on their purported development potential. Year after year, that cost the U.S. Treasury billions of dollars in lost revenues, federal officials said.

Court documents say that Fisher, a CPA, in 2002 began promoting and selling tax shelters he described as “real estate investment funds.” Sinnott, a licensed attorney, partnered with Fisher in 2013 to promote and sell the tax shelters. Their message: for each $100,000 invested, get charitable deductions worth $450,000.

“In total, the defendants and their co-conspirators sold over $1.3 billion in false and fraudulent tax deductions through this syndicated easement scheme,” federal prosecutors charged in a 135-count indictment.

Those deductions resulted in a loss of about half a billion dollars in federal tax revenues. Meanwhile Fisher —the mastermind of the scheme and one of its biggest promoters across the country — made close to $60 million from the deals, while Sinnott made $6 million.

Key evidence in the trial, which lasted more than two months, came from recordings by an undercover federal agent posing as a potential promoter. In one, Fisher explained that he and others working with him purposefully disguised the tax shelters as real estate investments in case the IRS audited any deals.

“We know if if we’re examined by the (IRS) they will ask for all promotion materials, so you have to be very, very careful that these look like real estate investments, you know, as compared to, you know, basically a tax shelter,” he said in one 2018 conversation.

Whistleblowers also provided key evidence. According to the government, in one recorded meeting, Fisher said he and others purposefully obtained fraudulent appraisals that overinflated land values by at least 30%.

However, Judge Batten said Tuesday that some values were falsely inflated 600-700%, above their purchase price on the premise of their supposed desirable development values.

“The defendants damn well knew there would never be a luxury hotel or high-end subdivisions built on any of these properties,” Batten said.

Attorneys for Fisher and Sinnott did not respond to emails from The Atlanta Journal-Constitution requesting comment.

Fisher sold the deals through his entity eventually known as Inland Capital Management. He owned and operated numerous other entities affiliated with it and its operation, including Preserve Communities, a purported development company for which Sinnott was president and COO.

In addition to the other charges, Fisher was also convicted of money laundering and ordered to forfeit personal assets purchased with funds generated by the schemes. They include an airplane, a Mercedes, a recreational vehicle, funds seized from various banks, a vacation home in the Caribbean Islands, a luxury condo in Asheville, and properties in Georgia, South Carolina and California.

Credit: Federal case file

Credit: Federal case file

The rulings come on the heels of a civil settlement in another Georgia syndicated conservation easement case that had resulted in more than $3 billion in federal tax deductions. Last March, Atlanta-based EcoVest Capital along with its promoters agreed to a permanent injunction barring them from promoting, selling or otherwise facilitating syndicated conservation easements.

Federal legislation signed by President Biden in December 2022 put an end to most syndicated deals going forward. However, the IRS has been aggressively pursuing audits and penalties against taxpayers who previously claimed the deductions. Currently, the agency is examining $21 billion in deductions from tax years 2016-2018, said Ronna Weyland, a public affairs officer with the IRS criminal investigation division in Charlotte.

In turn, some taxpayers have sued the promoters. Among the cases pending in federal court in Atlanta is a 2021 class action complaint by four Cobb County residents and others against multiple defendants, including Atlanta-based Strategic Capital Partners and Lilburn-based Bridge Capital Associates. That suit alleges that the defendants promoted and sold easements under the guise they were legal ways to serve the environment. Instead, the suit alleges, the defendants used a “prepackaged collection of bogus, grossly inflated appraisals (and) donations of easements that lacked a valid conservation purpose...”

Defendants denied the claims and argued that the investors had been warned about the tax and audit risks.

About the Author

The Latest

Featured