Ten years ago Saturday, an AirTran Airways Boeing 717 lifted from the ground into the night sky above Hartsfield-Jackson International Airport for the final flight of the scrappy underdog carrier.

It took off from the Atlanta hub that AirTran fought for more than 15 years to build in the shadow of behemoth Delta Air Lines.

On board, longtime employees and loyal customers who wanted to fly AirTran one last time sat in near silence, gazing out the windows at a crowd assembled on the tarmac bidding the flight and the airline goodbye. Hundreds of employees joined the standby list — just so they could get a boarding pass to remember the final fight.

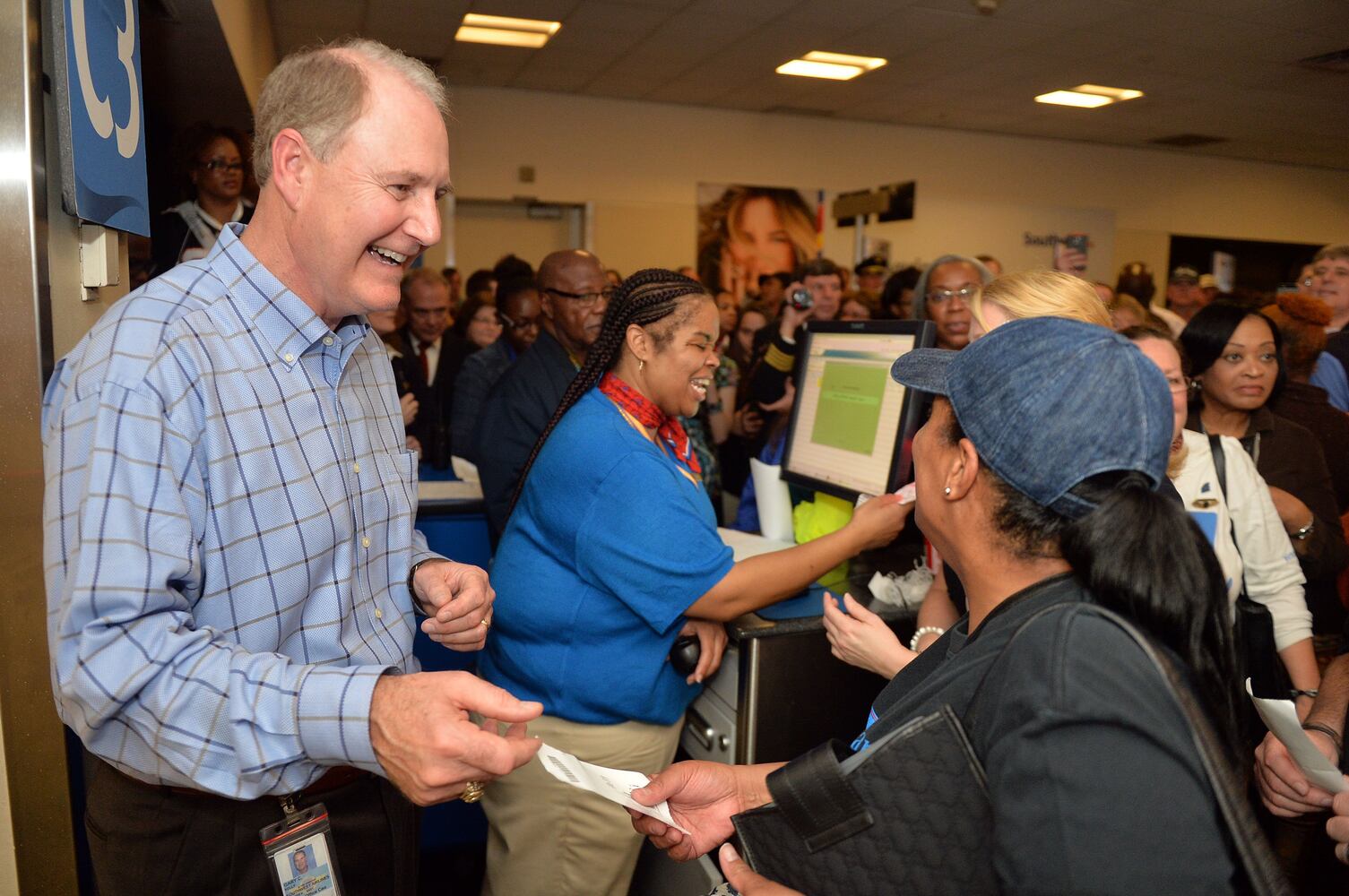

In the hours before takeoff on Dec. 28, 2014, employees hugged, celebrated and dabbed tears as they reminisced about the long hours, struggles and victories in building the airline. In 2010, Southwest Airlines had swooped in to acquire AirTran, and Flight 1 to Tampa brought an end to one chapter in Atlanta aviation history.

For many former AirTran employees and passengers, there’s still nostalgia for the airline that gained a loyal following among road warriors and other travelers — before it was absorbed into Southwest Airlines as a smaller No. 2 carrier at Hartsfield-Jackson.

Credit: Source: Southwest

Credit: Source: Southwest

Today, struggling Southwest, in a bid to transform its strategy, has laid out plans to add some of the same types of services that AirTran once had, including premium seats.

AirTran was known nationally for competitive fares, but as a serious competitor in Atlanta, it was also known for service that attracted people looking for an alternative to big legacy carriers like Delta.

With relatively affordable business class seats and a broad network from Atlanta, AirTran represented an attractive option for thousands of frequent travelers.

“AirTran was loved by Atlantans,” for its service, business class seats, and “unbeatable” rewards program, said Joe Leader, a Dunwoody resident who was such a fan of the airline that he had a dog he named AirTran.

AirTran “really was a perfect secondary airline here in Atlanta, and proved to be a fairly formidable contender for Delta,” said Leader, who is now CEO of the Airline Passenger Experience Association.

Credit: jspink@ajc.com

Credit: jspink@ajc.com

Kevin Healy, a former AirTran executive who is now CEO of consulting firm Campbell-Hill Aviation Group, said AirTran was competing for the frequent traveler who “is permanently No. 35 on the upgrade list. Never gets anything.”

AirTran swept in offering automatic upgrades for frequent travelers in its corporate program. But in Atlanta, AirTran had to go up against Delta, a much larger carrier that dominated Atlanta with more amenities to offer and a longer history.

“There’s not many people that would compete against Delta,” said Alison Head, a longtime AirTran flight attendant and union leader and one of nearly 5,000 former AirTran employees now working at Southwest. “What employees remember about AirTran is we were pretty scrappy.”

Healy keenly remembers what it was like trying to compete in the cutthroat airline industry as a low-cost carrier seeking to expand.

“Everyone’s shooting at you the whole time you’re there, and it seemed like the universe was against you,” he said. “But we always managed to figure out a solution and come out stronger.”

That kind of competition can bring benefits for travelers, in the form of lower fares and better service as airlines compete to win customers.

“I actually genuinely believe that Delta is now the industry leader because they had to compete with AirTran,” Healy said. “They had to get efficient. They had to get better at what they did.”

Credit: AJC staff

Credit: AJC staff

Don Turner, a frequent traveler who flew AirTran from Atlanta to Los Angeles weekly, said he was a loyalist because of the affordable business class seats.

There was a sizable market of frequent travelers like him served by AirTran, and “served very well,” he said.

While AirTran had fewer frills, Turner said AirTran crews knew him well enough that when he was flying back home on his birthday once, “they had a little birthday cake for me.”

Turner said he preferred AirTran’s straightforward offering of business class seats with enough room to comfortably work on a laptop, rather than pricier seats up front on airlines like Delta and American with extra luxuries like ice cream sundaes and amenity kits.

And, he said, “The problem with Delta (is) you have so many premium members that it’s tough to get upgraded.”

Credit: ASSOCAITED PRESS

Credit: ASSOCAITED PRESS

‘Skip the stampede’

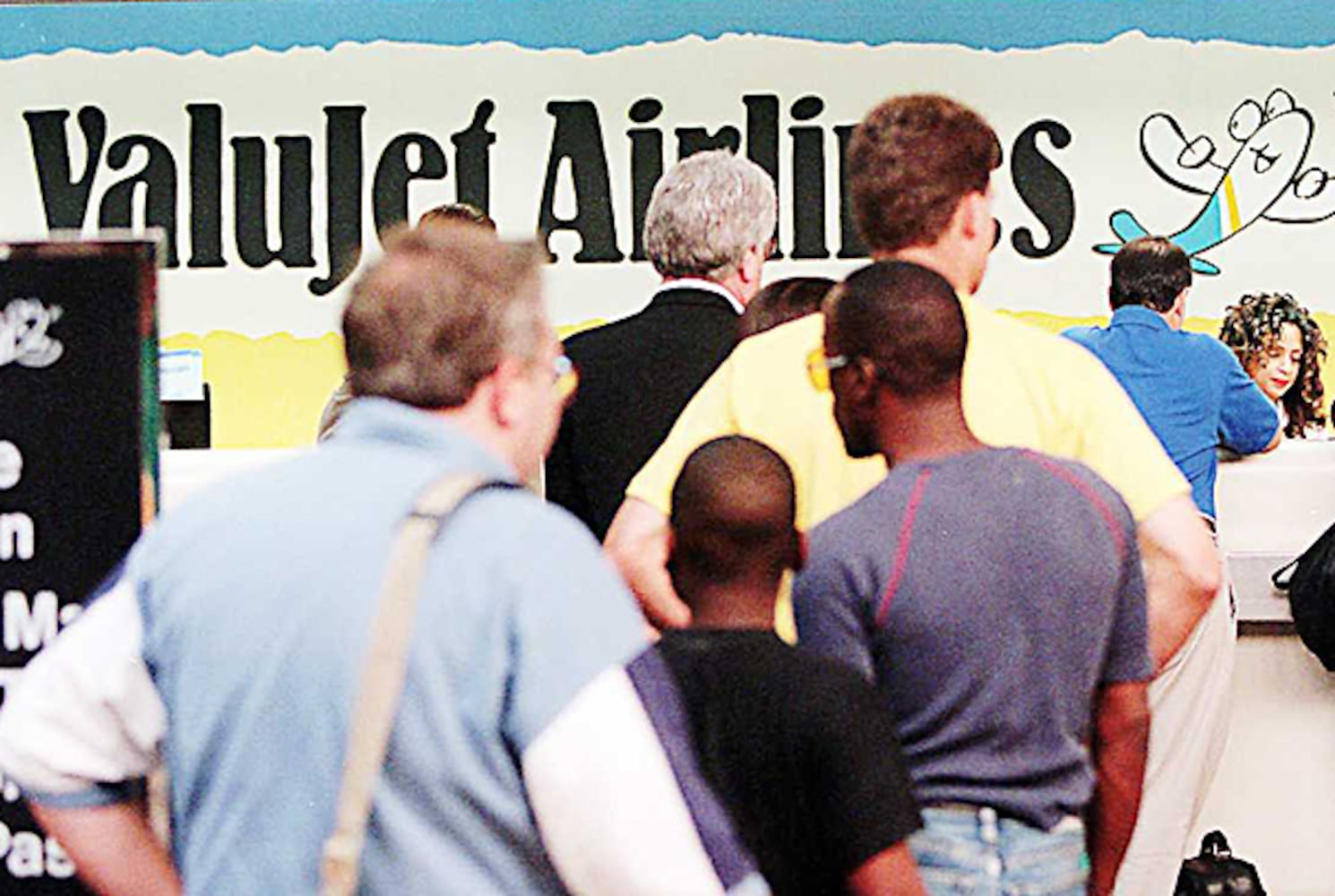

AirTran launched in 1993 as Atlanta-based ValuJet, in the wake of the 1991 failure of Eastern Airlines, a major hub carrier in Atlanta. The tragic 1996 crash of an Atlanta-bound ValuJet flight in the Everglades shortly after takeoff from Miami that killed all 110 people aboard led the government to temporarily ground ValuJet.

It started flying again months later, but the carrier never fully recovered and merged with Florida-based AirTran in 1997, taking on the new name.

AirTran was based in Orlando, but it would grow its biggest hub at Hartsfield-Jackson. With its new persona, and a chip on its shoulder, AirTran emerged as a capable rival for hometown Delta and low-cost carriers like Southwest.

AirTran was also known for cheeky commercials, including one that predated the Southwest acquisition and encouraged travelers to “Skip the Stampede. Fly AirTran Airways” with not-so-subtle references to Southwest’s boarding process at the time, which was often referred to as a “cattle call.” In the commercial, people in cow costumes rush onboard as an actor playing a gate agent calls them “udderly slow” — in contrast with a serene AirTran cabin shown with business class passengers relaxing in their seats before departure.

Credit: Kelly Yamanouchi

Credit: Kelly Yamanouchi

And AirTran scored a marketing coup in 2009 when it became the official airline of the Atlanta Falcons, after Delta had pulled out of the sponsorship.

At its peak, AirTran carried nearly 20% of passengers at the world’s busiest airport.

The beginning of the end for AirTran came when Dallas-based Southwest announced in 2010 a deal to acquire AirTran.

The two carriers made an odd couple. AirTran operated a hub-and-spoke system with Atlanta at its nucleus, and built a following by offering travelers just enough value and creature comforts to make it an attractive alternative to Delta for a significant portion of travelers.

Southwest operated a more dispersed point-to-point route network with a one-size-fits-all customer strategy — no assigned seats, all economy class and an all-Boeing 737 fleet.

Southwest at the time had become a darling of the airline industry, showing it could succeed even during periods when other airlines including Delta were losing hundreds of millions of dollars, furloughing workers and filing for bankruptcy protection.

With that record of success, Southwest ultimately folded AirTran into the Southwest model of operations, removing the business class seats and sending AirTran’s Boeing 717 fleet to Delta.

AirTran memorabilia

AirTran lives on in the form of memorabilia on display at Southwest’s headquarters in Dallas.

Credit: Source: Southwest

Credit: Source: Southwest

On the first floor, there’s a large model Boeing 717 with Elton John’s image on the side, from AirTran’s launch of XM satellite radio service on board at an event with the British star. It was previously on display at AirTran’s corporate headquarters in Orlando.

In a Southwest employee break room, a collection of AirTran commemorative shot glasses given out to key employees over the years is on display.

Credit: Source: Southwest

Credit: Source: Southwest

In the “One LUV” conference room, named for Southwest’s motto for the acquisition including its ticker symbol, there are photos from events to mark the day the acquisition closed in 2011.

More AirTran memorabilia is kept in Southwest’s archives, including commemorative pins and holiday neckties from AirTran’s final flight.

Credit: Source: Southwest

Credit: Source: Southwest

Now, when new employees are hired at Southwest, they’re taken on tours of the headquarters to learn about Southwest’s history — including AirTran’s role.

“It’s important to us to make sure that they see pieces of our past which help put the fabric of Southwest together,” said Richard West, Southwest’s corporate historian. The acquisition of AirTran “really was a path to help Southwest recover from the Great Recession,” he said.

Credit: Source: Southwest

Credit: Source: Southwest

Buying AirTran got Southwest into Atlanta, a market it coveted, and AirTran also gave Southwest a fast path to launch international service, since AirTran already had flights to the Caribbean and Mexico.

West said AirTran and Southwest employees had similar personalities, with a history of each airline “being kind of that scrappy fighter.”

A gradual shrinking in Atlanta

There were hopes that perhaps, Southwest could become an even stronger No. 2 competitor to Delta with a bigger presence at Hartsfield-Jackson. But that’s not what happened.

Credit: Southwest Airlines

Credit: Southwest Airlines

When announcing the AirTran acquisition, Southwest said it planned to grow in Atlanta.

Instead, over the years to follow, Southwest dismantled AirTran’s hub and severely shrank its route network from Atlanta.

AirTran at its height in 2008 had more than 19% of the market in Atlanta measured by passengers carried, and at the time of the AirTran-Southwest merger they still had close to 15% of the market. Southwest had less than 7% of the market in Atlanta in October, and that’s set to shrink even more.

Delta and its partners have become more dominant in the same stretch, going from 72.7% of the market in 2008 to 80% of the market today.

Credit: Natrice Miller / Natrice.Miller@

Credit: Natrice Miller / Natrice.Miller@

“There is gratitude for Southwest for securing the future of a secondary airline in Atlanta,” Leader said. I think we all simply wish that it would have been an airline hub in Atlanta that’s as strong as AirTran was.”

AirTran had about 220 flights a day from Atlanta at the time the merger was announced. Southwest is operating 80 to 90 flights a day from Hartsfield-Jackson now with more cuts to come. In April, Southwest will operate fewer than 60 flights a day from Atlanta. That’s less than a third of AirTran’s size in Atlanta.

“I think there were so many missed opportunities along the journey,” said Leader, who at the time of the merger started a campaign called AirTran SOS to try to convince Southwest to maintain AirTran’s business class seats. “The primary beneficiary of (Southwest’s) reduction has been Delta, followed by ultra low cost carriers like Spirit and Frontier,” which have grown in Atlanta in the years since AirTran’s final flight.

Along the way, Southwest has given up gates at Hartsfield-Jackson and is set to hand back even more to the Atlanta airport next year and reduce the size of its crew base in Atlanta.

As a result, Southwest flight attendants in Atlanta have “a little bit of sadness,” Head said.

“They feel like, you know, something that we fought really hard for is kind of being diminished at this point,” she said. “But I believe that we’re all committed to doing everything we can to make sure that we support and keep that customer base we have in Atlanta.”

Credit: Steve Schaefer/AJC

Credit: Steve Schaefer/AJC

Turner said he thinks Southwest “really should have understood the value proposition that AirTran offered.”

“People like me, as soon as you got rid of those business class seats, affordable business class seats — you know, I’m not going to fly Southwest from Atlanta to L.A.,” he said.

Southwest’s new strategy

This year, Southwest’s business showed some vulnerabilities, as it struggled through aircraft shortages with Boeing delivery delays, financial challenges and a takeover attempt by an activist shareholder.

Now, the airline has unveiled a strategy that is somewhat reminiscent of AirTran — plans to offer premium seating and seat assignments.

Southwest “is making the right moves now,” Leader said. “I wish that they would have made it sooner.”

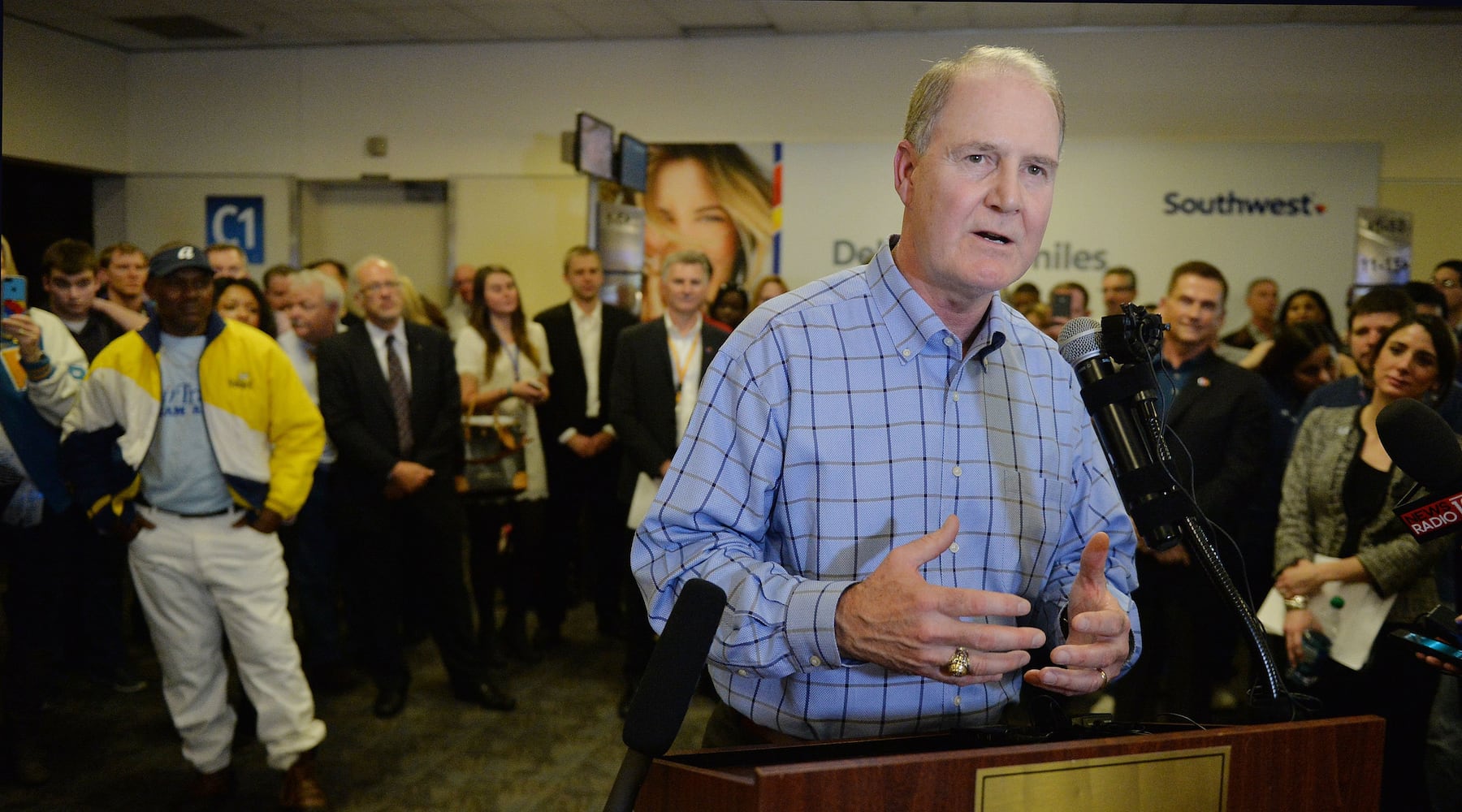

Southwest CEO Bob Jordan, who oversaw the integration of AirTran into Southwest a decade ago, said in a written statement that Southwest honors “the legacy of AirTran Airways by continuing to deliver award-winning hospitality through our amazing Southwest employees in the vibrant communities we serve.”

Jordan defended Southwest’s moves to shrink its Atlanta base during a recent aviation forum.

“We still have a very meaningful presence in Atlanta. We have over 50 flights a day,” Jordan said. While AirTran had more than 200 flights a day, “the dynamics are different,” he said, adding that AirTran made money by connecting passengers through Atlanta.

“I mean, it’s obviously tough to compete in a hub,” Jordan said. “You have scarcity of resources right now. … You’ve got to pick your place. And so you see us growing Nashville and growing Austin, where we see strong demand, and many other places, but at the end of the day, you’ve got to go where the demand is.”

Leader is still optimistic. With the changes Southwest is making now, “I think it will help them to recapture market share over time in Atlanta.”

About the Author

Keep Reading

The Latest

Featured