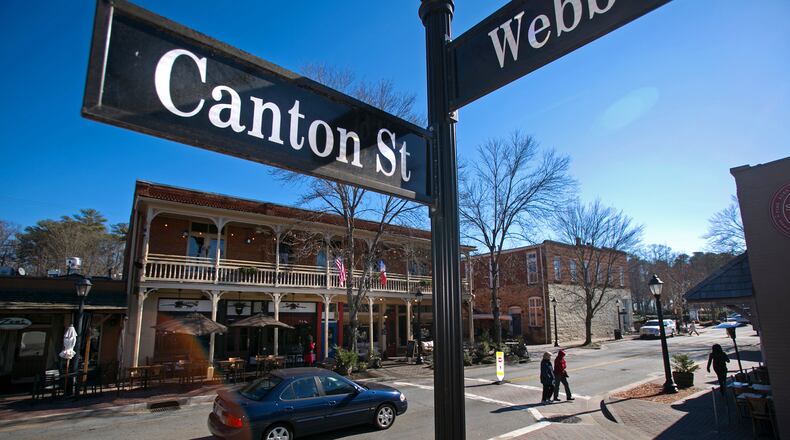

Winter is coming, and restaurants and other establishments relying on outdoor seating during the pandemic face economic challenges. Roswell small business owners say a potential change to the city occupational tax is not helping.

From the Earth Brewery Company owner Tim Stevens and other small business owners have contacted Roswell Mayor Lori Henry and City Council members asking them to not increase their bill.

“I understand income is important to the city,” Stevens said. “I was hoping they would revisit this after people have recovered from the pandemic. Any increase is kind of a dagger in the heart with sales being so dramatically hit.”

The city is tweaking its business occupational tax structure for 2021 after an official noticed a disparity in what large and small businesses paid the previous two years. For example, the tax rate for holding companies, real estate and rental firms decreased by half after 2018, according to a report by City Finance Director Ryan Luckett. Comparatively, the tax rate for restaurants remained the same.

Occupational tax bills are calculated using factors such as total gross receipts, deductions and number of employees.

Roswell collects less money in business license fees than neighboring cities. A report compiled by Luckett shows that a restaurant with $1 million dollars in gross receipts and 19 employees would’ve had a $330 tax bill this year. The same business would’ve paid $1,499 in Johns Creek and $1,254 in Sandy Springs.

Officials say the goal is to keep business taxes generally where they are currently. One idea is to keep the dollar amount that a business pays the same, Luckett confirmed Monday. Such a scenario would seem to hurt restaurants and others where revenue has dropped during mandated coronavirus restrictions.

Another possibility is to keep the tax rate the same and the payment would depend on the company’s gross receipts.

Luckett has suggested to Council members that instead of reporting estimated gross receipts for the year when paying their tax, the business would report the prior year’s actual receipts. Council members have held committee meetings on the issue and will vote on any changes during a regular meeting.

Ryan Pernice, owner of Table and Main and Osteria Mattone restaurants in Roswell and Coalition in Alpharetta, said that while city officials are deciding their next move, he is spending a lot of money to make less money.

Pernice said his restaurants' business has improved, but for the year revenue is down 37% at Table and Main, 25% at Osteria Mattone and 53% at Coalition. And thousands of dollars have been spent on heaters, a fire pit and safety shields between tables, as well as filtration systems to allay patrons' fears that the coronavirus can be spread through the air conditioning, he said.

If 60 diners come to one of his restaurants, half dine on the outside patio, Pernice said, adding that last week, which included sunny and warm weekend weather, business was the best since reopening in the pandemic.

But Pernice, Stevens and Jenna Aronowitz, who owns 1920 Tavern in downtown Roswell, said coming colder weather is a concern for continued recovery.

Pernice said restaurant owners have only a portion of the market they had before the pandemic.

“Twenty percent think it’s a hoax,” he said. “Twenty percent won’t eat out again and we’re fighting to get the 60%.”

With the uncertainty of the winter months and the pandemic’s end, Aronowitz said her approach is to take each day as it comes. Her restaurant patio is full most days and business has rebounded to what it was before the pandemic, she said, but there have been ebbs and flows.

Aronowitz said that after meeting with the mayor and each City Council member, she is confident that any possible vote on business taxes would favor small businesses.

“We don’t know what’s going to happen,” Aronowitz said. “Any kind of increase is nothing any of us should have to deal with right now. Let the city have our backs.”

About the Author

The Latest

Featured