When you’re gone, what happens to your pets?

When Jean Allred was doing her estate planning, first and foremost were her babies.

She wanted to ensure that Jack, Molly, Annie and Gordon were well taken care of after she died or if she became incapacitated.

That includes money for expenses like food, bedding and medical care.

Her babies are of the four-legged variety, and her planning illustrates a growing trend.

Currently, 67% of U.S. households own at least one pet, and many people now consider long-term planning for them just as important as they would for two-legged family members.

“They were kind of like No. 1,” in terms of planning, said Allred, 58, a quality control manager who lives in Marietta. “If you think about it, animals are completely vulnerable. They can’t take care of themselves. If something happened to me, I’ve got to make sure they’re cared for and that somebody doesn’t take them to a shelter and they’re euthanized. That just keeps me up at night.”

Indeed, for many households, pets are viewed as valued members of the family. They provide companionship, and studies show they help reduce stress.

They sleep in the same bed. Their owners take them to restaurants and on vacations.

In fact, a 2018 Realtor.com survey found that 79% of millennials who bought a home said they would pass on an otherwise perfect home if it didn’t meet the needs of their pets.

Estate lawyers and investment advisers are aware of the trend.

Fidelity Investments offers tips on its website for pet owners, advising people to be upfront about what it takes to care for your pet. Fidelity also advises that once a caregiver has been identified, a plan should be put in place that details what needs to happen immediately after the death of the owner.

Pets, though, are considered property and have no legal rights, so it’s up to you to plan for their care.

Some questions you may want to explore:

• What is the difference between a pet trust and a will?

• Does it vary by state?

• Is the trust independent from the will?

• What happens to the leftover funds after your pet dies?

• Can you designate money from your 401(k) to care for a pet?

To come up with a plan, Allred looked at the life expectancy of each animal and factored in the average vet bill, food and extra money in case something catastrophic happened.

According to the American Society for the Prevention of Cruelty to Animals' pet care cost table, the annual cost to care for a dog can range from $737-$1,040.31, while the annual cost for cat care is around $809.

The cost of caring for both dogs and cats can vary depending on age, breed, weight, and other qualities such as special medical or training needs.

Some pets can live even longer. Horses generally have long lives, and certain birds can live more than 70 years.

For Allred, it was more than financial, though.

She had to find committed caregivers. A brother, who is the executor of her estate, agreed to take her two dogs, Jack and Molly. Allred stipulated that the two dogs stay together and that her cats not be separated.

She’s been in a similar situation.

Several years ago, a neighbor asked her would she look after his mostly feral cat, Gordon, if he died. She agreed.

Not long after, the neighbor died unexpectedly of a massive heart attack. “I never had second thoughts,” Allred said. “I went right down there and got him.”

Their arrangement was informal, although experts say owners should have a committed plan and legal caregiver. It also helps to check in with your designated caregiver. Situations change.

Someone who agreed to take your pet three years ago may develop a health or other personal issue.

Allred’s neighbor didn’t leave money to care for Gordon, but that didn’t matter to her. That may not be the case with others.

When Erika Orcutt, a Kennesaw attorney, first started her practice 20 years ago, she saw very few cases in which clients even talked about including pets in their estate planning.

Now it’s about 20%.

She often asks clients if they have pets and whether they have a plan in place for their care. “It’s definitely gone full spectrum in terms of being an item in the estate planning process,” she said.

Most people don’t think about including the pet in estate planning.

More than likely, they expect family members and friends to do the right thing, “and that can be problematic, but something you can avoid with advance planning.”

In Georgia, pets are considered property, so you can’t leave anything to them directly in a will, she said.

You can, however, leave money to a loved one or friend to care for the pet, but there’s no guarantee the money will be used to that end.

“Once you give the money to that person, there’s nothing to force them to spend it on the animal. You can leave $5,000 to your sister, Jane, to care for the animal, but that doesn’t have the same teeth (as a trust). Once Jane gets the money, there’s no real way to force her to spend it on the animal.”

A trust, though, is more legally binding when it comes to caring for animals, Orcutt said. It can also be specific, including how often a pet should see the vet and cover its standard of living.

In a pet care agreement, the executor or lawyer could go to court to enforce the contract.

Typically, a trustee will hold property “in trust” for the benefit of the person’s pets, according to ASCPA. Payments to a designated caregiver will be made on a regular basis. The trust, depending upon the state in which it is established, will continue for the life of the pet or 21 years, whichever occurs first. Some states allow a pet trust to continue for the life of the pet beyond the 21 years.

Related: Escaping hell: After life in a cage, how do dogs adjust?

Many experts advise against a will alone.

It takes time for a will to be probated, and there could be challenges. What happens to the pet then?

The general responsibility of the executor is to oversee assets of the estate, and property is one of them. It is different, though, when that property has be fed and walked.

Relatives or close friends are often looked to to fill the void, but may not have an interest in caring for a pet or the ability to do so.

Atlanta attorney Nancy Goodman said a pet cannot be named as a beneficiary of 401(k) or IRA.

“It is possible to name a trust as a beneficiary of a retirement account, but the funds would be subject to immediate taxation if payable for the benefit of a pet,” she said. Goodman added that it’s generally advisable to use retirement funds to provide for a person or persons, so that required minimum distributions are payable — and taxed — over the lifetime of the oldest beneficiary. That preferred tax treatment doesn’t work for non-persons such as animals or charities.

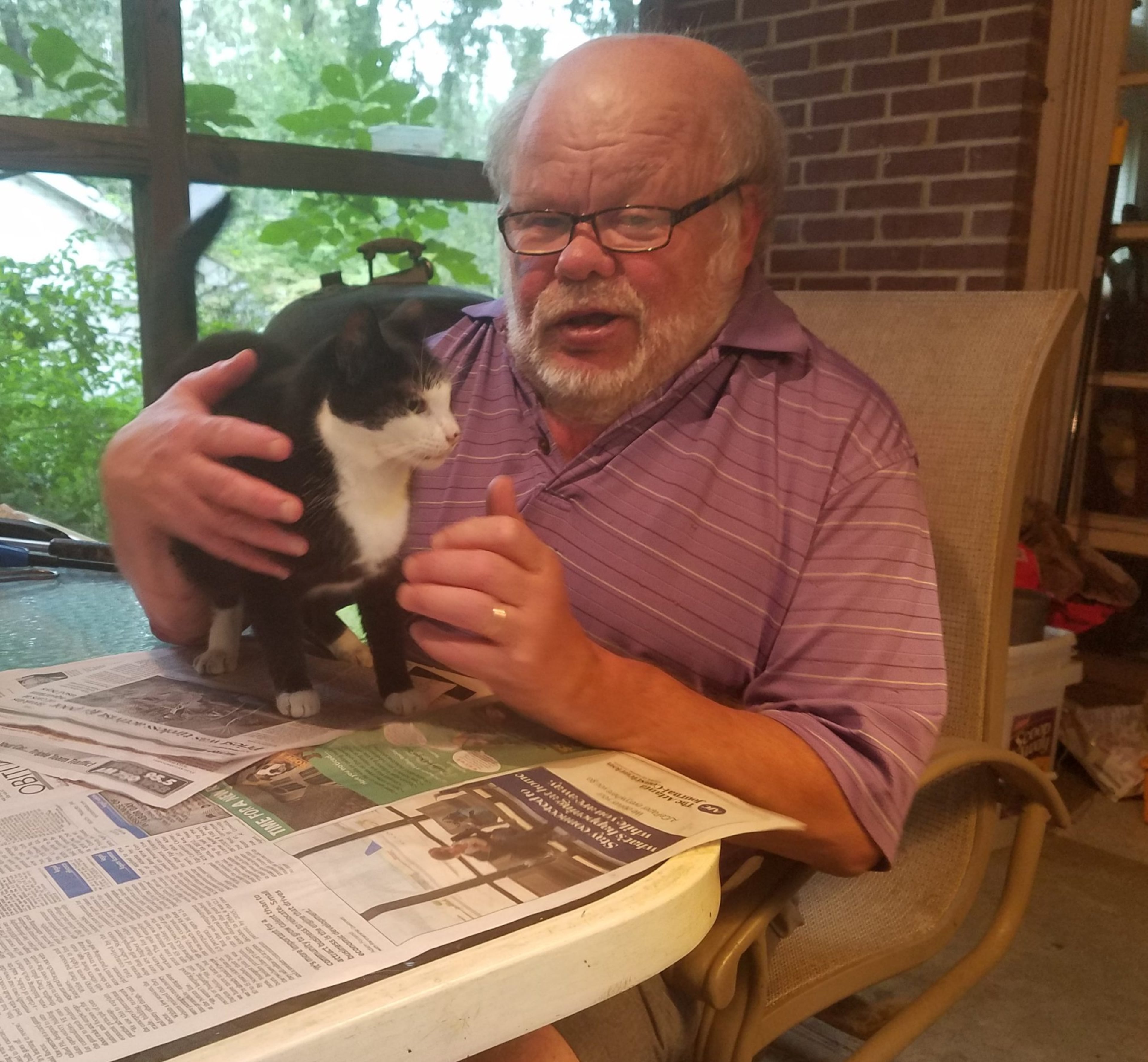

Gene Gettler and his wife, Laura, who are in their mid-60s, own four cats, but they also help take care of several feral felines that wander his East Point neighborhood.

The Gettlers, who own a fencing school, prepared their wills last November. Gene Gettler was going to have surgery the next month, and they figured it was best to have their affairs in order.

And that meant looking out for their cats.

“We love them and we don’t have children, so they rule the roost,” said Gettler, who reads the newspaper every morning as his cat Bandit looks over his shoulder. “We love cats and we wanted to basically make sure that if they outlive us, they are taken care of.”

A close friend agreed to either care for their cats — which range from 7 to 10 years old — or make sure they had a good home. They set aside enough money for their care.

If there’s no set plan, a beloved pet can end up in a shelter or abandoned.

Ask Karen Hirsch, a spokeswoman for the Lifeline Animal Project, which manages the DeKalb and Fulton counties' animal services.

Several times a month, a dog or cat is brought into the shelter because the owner died or became too ill to care for the pet and hasn’t made provisions in a will or trust or there’s no relative able or willing to step forward to care for the animal.

“You don’t want your pet to end up in a shelter,” said Hirsch, whose own pets are included in her will. “It’s a scary place, especially if they’ve been in a home all of their lives and been loved by somebody who’s now gone. They can be confused and scared.”

They may stop eating, whine a lot or become depressed. They don’t understand why they are in this new place without the person who may have cared for them for years.

Related: Pet owners cope with loss of their best friends

“It’s certainly not what their owner would want for them. People just don’t think about these things.”

Sandy Hackler did.

Hackler, who lives in West Cobb, owns three horses and three dogs.

She started thinking about estate planning when she got her first horse about 17 years ago

“Horses are not readily passed down in a family like a dog or other animal might be,” she said. “You can just give your dog to your sister.”

Today, there is a trust for the care of her animals after she dies. A longtime friend and fellow horse lover has agreed to take her three horses — Profe, Mae and Doc — who are 24, 25 and 18, respectively. Money is set aside for their care for the rest of their lives. The funds will be released in increments over time to be used for medical expenses, boarding and feed.

Hackler, 64, admits she was picky about finding just the right caretaker who would love her animals as she does. Horses, depending on the breed, can live anywhere from 25 to 30 years, so she had to be meticulous about the financial planning.

As for her three dogs, she has also set aside money for their care. Her one human child — her son — has agreed to take them in, but the two travel a lot together, so she has a contingency plan in place that includes other family, friends and members of a Lab rescue group.

Related: Rescue Me: Lucy steals writer's heart

More: Hundreds of shelter animals find new homes

Hackler volunteers at a local shelter and has seen pets come in whose owners didn’t make arrangements. “It’s heartbreaking.”

She said it’s a big enough issue that if an older person wants to adopt a pet, workers make sure the potential owner understands the importance of having a will or trust in place. Once a person who was 90 came in to adopt a dog, and she and other shelter workers required the adopter to show a “verified plan” was in place for the animal before they let him go.

“They’re family,” said Hackler of her animals. “You wouldn’t want to leave your children with no advance care if something happens to you.”

ESTATE PLANNING THAT INCLUDES YOUR PETS

- Consult with an attorney and financial adviser.

- Research pet care and trust information that may vary by state.

- Select the pets' guardian and perhaps a backup, should the original guardian die or become ill. Be sure that the person chosen has given their clear consent.

- Make sure the agreement is legally binding and not just a handshake.

- Write detailed instructions for the pets' care. This information may be especially useful immediately following the death of the owner. It can include medical information, health issues and daily care.

- Formalize plans in a pet trust or pet protection agreement. These legally binding agreements can provide for the care of your pets when the owner is incapable of caring for them.

- Select a remainder beneficiary. This person or organization will receive any funds left in the trust after the pets die.

Sources: Fidelity Investments, staff