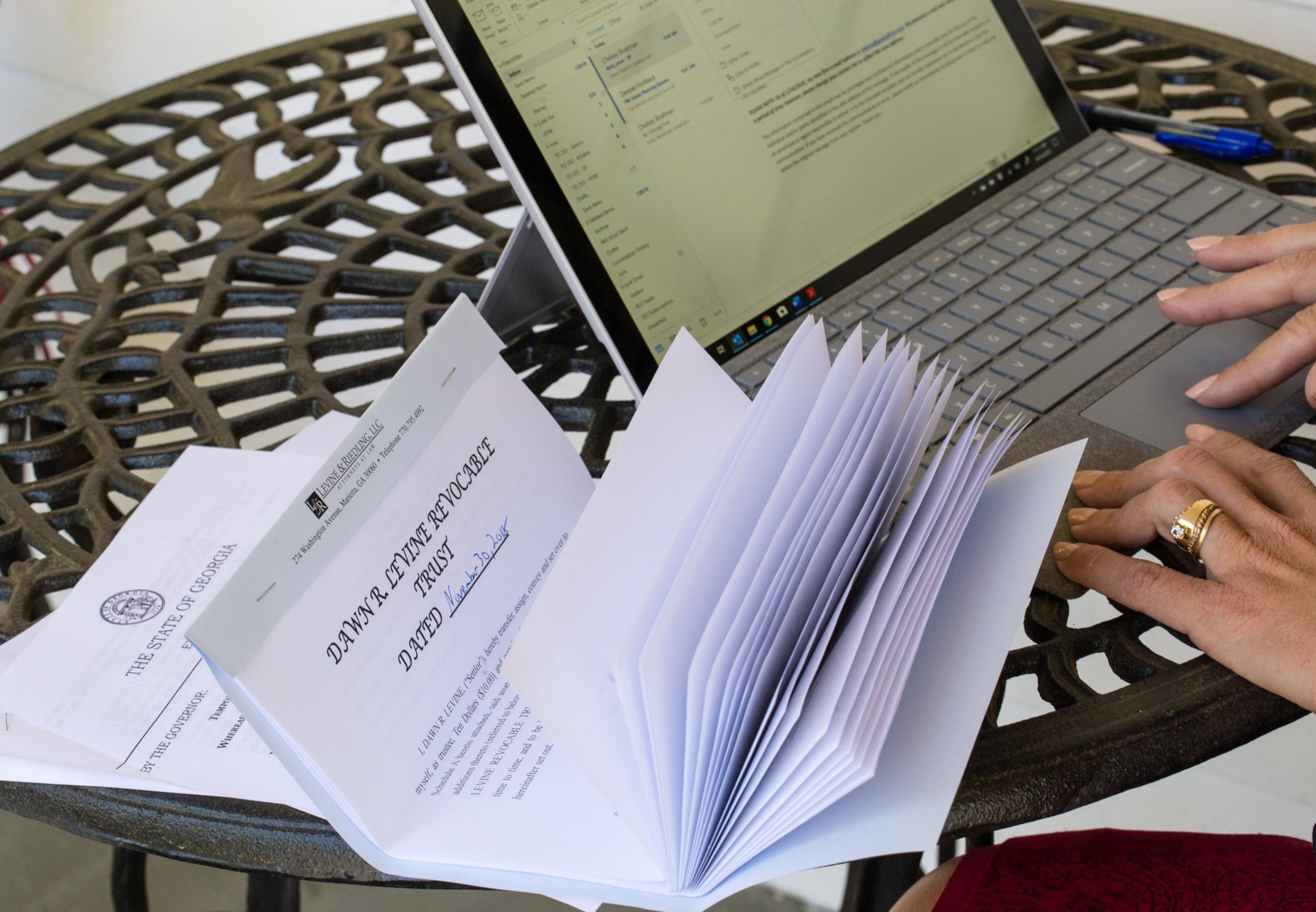

How to write a will in Georgia

Attorneys specializing in end-of-life affairs say they are seeing a surge in requests for help with wills and end-of-life documents over the past few weeks.

While the writing of the will itself is a relatively simple task, it is best to do it under legal supervision to make sure you don't overlook important details.

Here's a look at recommended steps from LegalZoom and things to think about when getting started writing your will.

1. Create the initial document.

Start by titling the document “Last Will and Testament" and including your full legal name and address.

2. Designate an executor.

The executor acts as your personal representative who manages and distributes the assets of your estate. While testators (people writing wills) commonly choose a friend or close family member, consider naming your attorney or financial advisor in order to ward off any potential problems.

3. Appoint a guardian.

It's important to name a guardian to care for your minor or dependent children in the event you are the last surviving parent or the surviving parent is unfit to care for them. Otherwise, the court will appoint someone.

4. Name the beneficiaries.

Beneficiaries are the people who stand to inherit your assets after you die. Your beneficiaries may include your spouse, children, relatives, and close friends, among others. Whatever you do, don't name your pet as a beneficiary. Instead, designate a person to care for your pet.

5. Designate the assets.

Make a list of your assets and decide who will inherit what. If you plan to disinherit a family member, make sure you name the person in your will and the reasons behind your decision, if you so choose.

6. Ask witnesses to sign your will.

After you've finished writing your will, ask two persons to serve as witnesses. The witnesses must be over 18 years old and not be beneficiaries in your will. Also, it’s recommended to get notarized in Georgia.

7. Store your will in a safe place.

Keep your will in a safe place such as a safe deposit box and let your executor know where it is. You may want to review your will every two to three years, especially after a major life change such as a divorce, birth or death.

Additional circumstances.

Bill Rhoads, an estate planning attorney and partner at Smith, Gilliam, Williams, & Miles, a firm in Gainesville, Ga., recommends people also consider the following:

Georgia advance directive for health care.

In his view, this is the only emergency document. It allows a person to name a health care power of attorney so that if you are incapacitated or otherwise cannot make health care decisions for yourself, someone else has the authority to do so. This document also allows a person to state their health care treatment preferences so there is guidance for providing nutrition or fluids by tube, breathing ventilators, and other life sustaining treatments. Previously, it was known as a living will. Hospitals will routinely ask for it so that they have knowledge of who has medical decision-making authority for a patient in the event the patient cannot make decisions for themselves.

Check beneficiary forms.

Often clients may not have complete beneficiary forms or may have incorrect beneficiary forms for investment accounts or insurance policies. For any retirement accounts, such as 401(k)s, IRAs, 403(b)s, or any investment or brokerage accounts, or any life insurance policies, it is important to make sure both a primary and secondary beneficiary is listed. Often the primary beneficiary will be a spouse — but if a spouse has predeceased, or if there has been a divorce, not updating this information can lead to unintended consequences. Maybe a first child was listed as a beneficiary and now a client has three children but the other two were not listed — then only one child is entitled to the funds.

Check house and real property deeds to see if property is held in a survivorship capacity.

Often the intent of married couples is for a residence to automatically go to the survivor of them at the death of the first — but this is often best handled through real estate deeds rather than through wills.

Take extra caution if blended families.

If there is a second marriage or more for either spouse, or children from prior marriages (even if adult children), then careful thought is required because the surviving spouse may not want to share with the predeceased spouse's children from a prior relationship — or vice versa.

Take extra caution in other special circumstances.

Do you want a minor child to potentially inherit real estate or significant money when they reach 18 year old? Are any children or spouses receiving government benefits which have asset or income qualifications so that an inheritance could disqualify the spouse or child from those government benefits? Does a child have a spending or addiction problem so that assets could potentially be spent in a way other than how you intend.