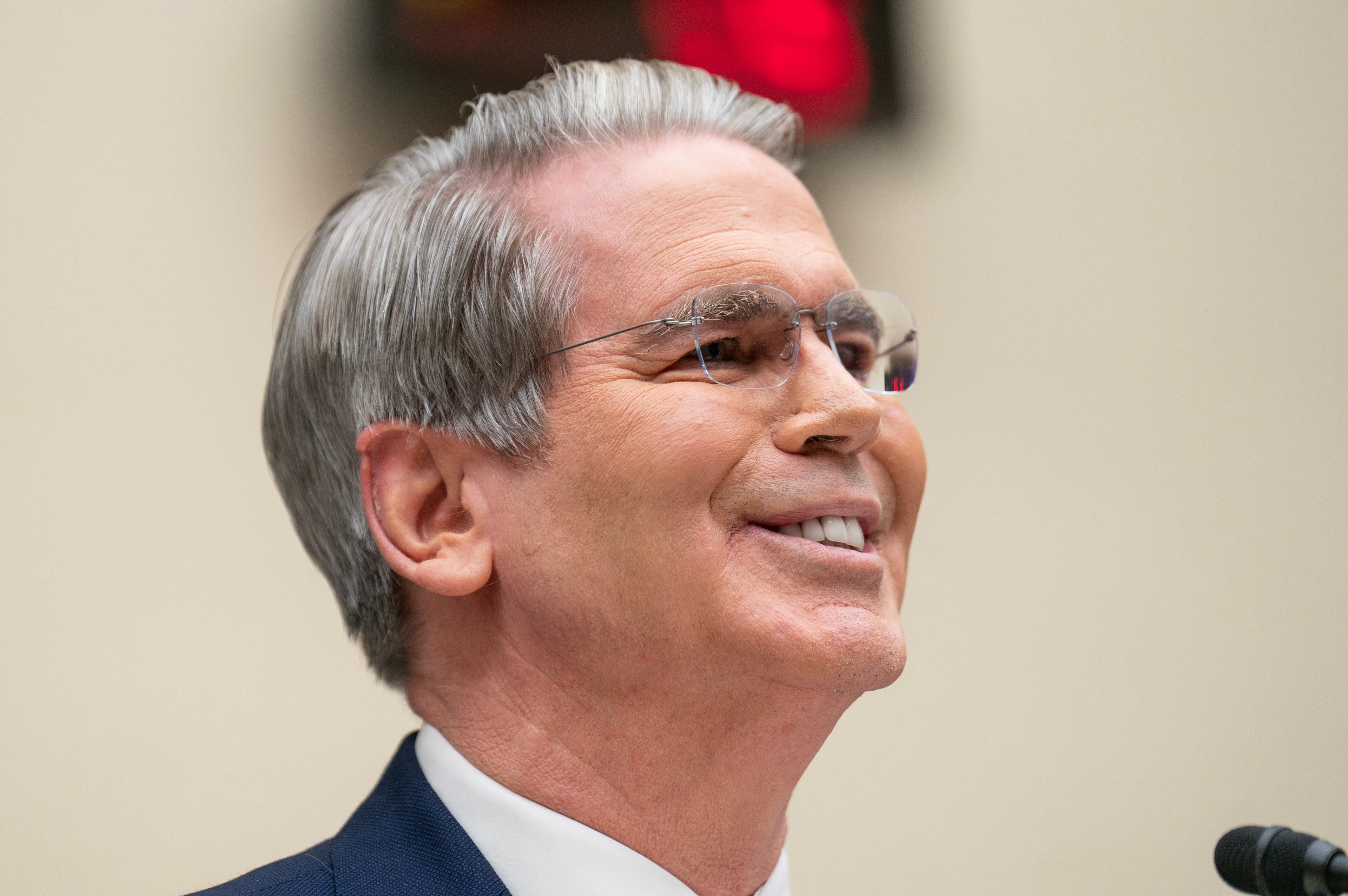

Wes Moss: Planning the 5 years prior to retirement

When you get to this place, it may be hard to believe. After all, we work all of our adult lives with this magic moment in mind. And now, it’s just over the horizon, so close you can almost see it. I’m talking, of course, about retirement.

When you’re just a handful of years away from stepping into this beautiful chapter of life, it can be exhilarating. And a little scary, perhaps, as it becomes more real.

Questions come to mind, like how you’ll spend your days when your time is your own, or where you’ll call home in your post-career life. Asking yourself such questions and imagining the answers is critical to shaping a financially secure and happy retirement.

Use these visions of your future to start addressing the nuts-and-bolts aspects of your looming retirement. Decisions you make during these "winding down" years can impact how happy you are during these rich years. According to research for my book, "You Can Retire Sooner Than You Think," the average happy retiree spent about five hours a year planning for the various aspects of their retirement.

Here is my list of to-dos for the final five years before you call it a career.

Five Years Out — The Year of Financial Bearings

This year will set the foundation for the rest of your efforts. It’s time to get a clear picture of your retirement budget — not just your projected spending, but how much income you require to meet those expenses.

One way to get an idea of your financial life as a retiree is to use my "Fill the Gap" strategy — it's relatively simple, yet it can be a powerful tool for you to use.

Start by determining your income. Take all of your retirement income streams (from sources like Social Security, rents and pensions) and add them together and subtract enough to cover the tax bite. If you determine you will receive $3,500 per month (after taxes), that’s your “take-home income.”

Next, figure out your monthly spending. Tally up your monthly expenses. Let’s say your monthly expenses come out to $5,000 per month.

Now, find your gap. Subtract your take-home income from your spending need. Here, we have: $5,000 – $3,500 = $1,500. So, the $1,500 figure is the perpetual gap you need to fill. Remember this number will need to be adjusted over time for inflation, and as your spending adjusts.

Here's where your investments and savings come in. The 4 Percent Rule says that a retiree can withdraw 4 percent of their initial retirement savings, and increase that amount every year to account for inflation, assuming a 50 percent to 75 percent portfolio allocation to stocks. According to my research, using this rule, investments should last 20-plus years, assuming you are invested appropriately.

Be honest in these calculations. If you are too short on money, there’s still time to boost your savings, seek higher investment returns or maybe even push back your expected retirement date.

If you find this sort of calculation daunting, consider enlisting the help of a financial professional. Choose one whose philosophies match your own, and who comes well recommended. Friends and co-workers can be a good source of referrals.

Four Years Out — The Year of Planning for Eventualities

The national median cost for long-term care last year ranged from $48,000 to $97,000.

Understandably, many people consider buying insurance to cover that expense. Long-term care insurance can be expensive. Some people choose to reduce that cost by purchasing a policy that covers only part of their expenses. Others choose to forgo it altogether. Remember as you shop that there is a significant chance that you may never need long-term care.

But if you have saved aggressively, you might not even need such a policy. Some financial professionals recommend long-term care insurance only for people whose net worth is in the range of $500,000 to $2 million. Those with more than $2 million socked away, they say, can probably cover their own care costs, or “self-insure.” This is a personal decision that you must make based upon your own unique circumstances.

In my opinion, long-term care insurance is iffy at best. The industry has been fraught with skyrocketing premiums in recent years that just leave me with an arched eyebrow. Make a decision that feels right for you, nonetheless. Just make sure that if you start paying the premiums that you can afford to pay them over the long haul so you don’t end up losing coverage.

Three Years Out — The Year of Core Pursuits

This is my favorite year for retirees — when they explore what they’re passionate about. There is, after all, more to retirement planning than money.

Use this year to decide how you want to spend your days in retirement. My research on happiness in retirement found that happy retirees have an average of 3.6 “core pursuits” — activities they pursue with a passion. Some of these are lifelong loves; others are picked up in retirement.

So, what are your core pursuits? If you don’t have any (not uncommon), now is the time to start exploring your passions. Try new things and see what you end up loving.

Also, use this year to assess your house and mortgage. If your home needs repairs or updates, take care of those now, while you are still getting a regular paycheck. And here’s what I know about mortgages: The happiest retirees, based on my research, have either paid off their mortgage or are within five years of doing so.

Two Years Out — The Year of Revisiting

Now’s the time to run the numbers (again). Pull out those income and expense numbers from Year Five. How are they looking now? Do you need to make any more changes to your plan — or expected retirement date?

And practice makes perfect. Use this year to live entirely on the monthly income you expect to have in retirement to see how it works. This demanding, but powerful, exercise can provide unique insight that might prompt you to tweak your retirement plan and/or expectations.

One Year Out — The Year of Reviewing

Review your health insurance needs. We all know that Medicare starts at 65, so if you’re retiring before this age, you’ll need to look into COBRA, a program that allows you to keep your employer-provided coverage for 18 months after you retire, or buy a policy under the Affordable Care Act (Obamacare). Be prepared for sticker shock, though, as both of these options come with hefty price tags.

Review your asset allocation (again). If your portfolio is set to deliver the income you need in retirement, consider converting some of your stock holdings into cash and other short-term investments. Consider employing the 15/50 Stock Rule, which states that if you believe you have 15 years left on this planet, your portfolio should consist of at least 50 percent stocks, with the remaining balance in bonds and cash. The goal is to strike a constant balance between risk and reward. The stock allocation can be made up of either dividend-payers or growth stocks. You just need to keep an eye on your portfolio and reallocate as necessary to prevent stocks from creeping beyond the 50 percent mark.

Wes Moss has been the host of “Money Matters” on News 95.5 and AM 750 WSB in Atlanta for more than seven years now, and he does a live show from 9-11 a.m. Sundays. He is the chief investment strategist for Atlanta-based Capital Investment Advisors. For more information, go to wesmoss.com.

DISCLOSURE

This information is provided to you as a resource for informational purposes only. It is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal. This information is not intended to, and should not, form a primary basis for any investment decision that you may make. The information contained in this piece is not considered investment advice or recommendation or an endorsement of any particular security. Further, the mention of any specific security is solely provided as an example for informational purposes only and should not be construed as a recommendation to buy or sell. Always consult your own legal, tax or investment advisor before making any investment/tax/estate/financial planning considerations or decisions.

IN OTHER NEWS:

More Stories

The Latest