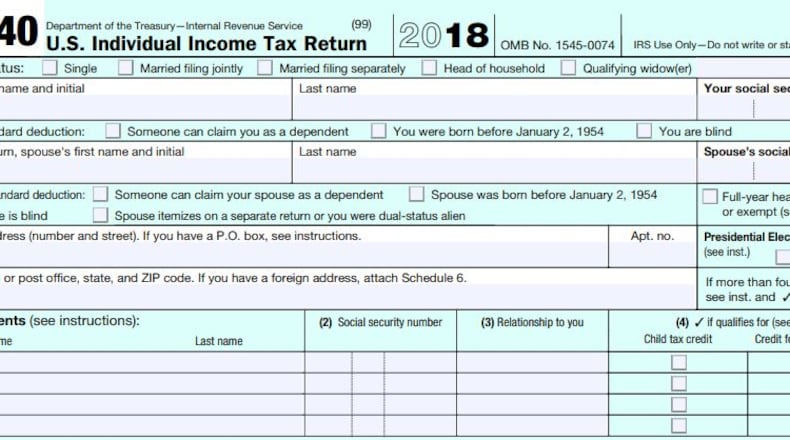

With a growing debate on social media and in political circles about the impact of the GOP tax cuts as Americans file their taxes for 2018, the Treasury Department on Monday disputed reports that the tax cutting plan had failed to deliver tax savings, amid stories of a drop in the size of tax refunds early in the tax filing season.

"News reports on reduction in IRS filings & refunds are misleading," the Treasury Department tweeted, though that was followed up with a recommendation for all taxpayers to make sure their tax withholding is being done correctly on their paychecks.

"Go to the IRS withholding calculator to make sure you are properly withheld and receiving the full benefits of the new tax law," Treasury tweeted.

The statement from the Trump Administration came amid a surge of postings on social media by taxpayers around the country, expressing surprise that the size of their tax refund had shrunk, or even evaporated, as some took the opportunity to blame the tax cuts backed by President Donald Trump.

While the Treasury Department says news reports have been 'misleading' - the early data from the IRS does show a drop in the size of tax refunds paid out so far, down 8.4 percent from the same point a year ago, according to the most recent statistics.

But the story is more complicated than the size of a tax refund - investigators from the Government Accountability Office warned last year that millions of Americans had not changed their tax withholding to synch up with the new tax laws - and some of that will mean a tax filing surprise before April 15.

The reason for that surprise is that the Internal Revenue Service altered the tax tables - the amount which employers hold out of your paycheck and send to Uncle Sam - in an effort to speed even more money to workers.

When less money is being withheld from your paycheck, that can mean in some instances that you aren't paying enough to the IRS, which can result in either a smaller tax refund - or in some cases, the need to pay a tax bill to the IRS.

Thus, it's possible you could pay 'less' in taxes overall, but still see a smaller tax refund.

But some of the Twitter responses to the Treasury Department tweet indicated a difference of opinion.

Credit: Jamie Dupree

Credit: Jamie Dupree

Credit: Jamie Dupree

Credit: Jamie Dupree

Credit: Jamie Dupree

Credit: Jamie Dupree

"Who yeah gunna believe? Your ‘lying’ bank account or the US Treasury?" tweeted @MTorganizer. "I think we all know what the bottom line on our tax return says!"

"I think I know what my tax return says," wrote @Tatortots2003. "That was a huge loss for my family."

About the Author

The Latest

Featured