Property tax rates are holding steady in most of DeKalb County this year, but some residents will still receive higher bills because their homes gained value.

Tax rates will remain unchanged in unincorporated areas, according to DeKalb CEO Mike Thurmond's proposed mid-year 2017 budget.

In the county’s 13 cities, tax rates for county government services are rising slightly in three. In the other 10 cities, county tax rates are either declining or staying the same.

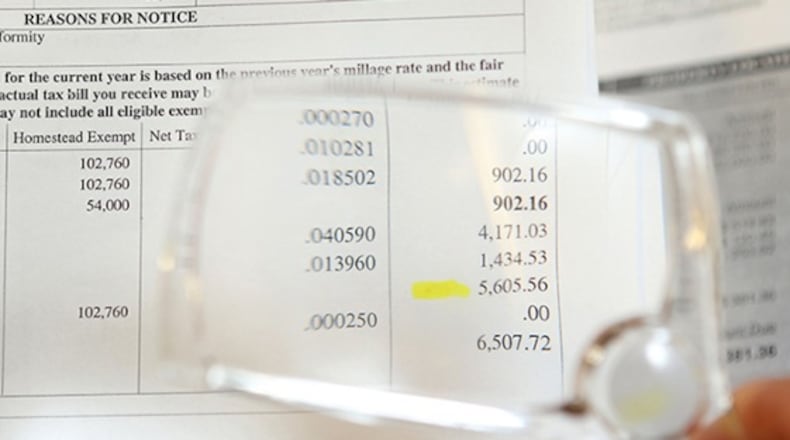

Because tax bills are calculated by multiplying assessed property values and tax rates, residents whose homes gained value this year will owe more money.

Residential real estate values increased nearly 8 percent this year across DeKalb, according to the county's assessment data.

All DeKalb residents pay the same tax rate for general operations — including courts, libraries, the county jail and animal services — as well as hospital services. That tax rate will be 9.483 mills this year, or about $9.48 per $1,000 of assessed property value before exemptions. That's a decrease from 9.5 mills in 2016.

The tax for police, fire and parks varies depending on whether residents live in cities that provide those services.

In the three cities where county tax rates are rising — Brookhaven, Chamblee and Dunwoody — the cost of fire protection is the primary reason for the increase. The tax for fire services is going up countywide, but in unincorporated areas it’s offset by decreases in tax rates for other services.

Tax rates are set by governments of the county, its school systems and its cities.

The DeKalb Commission is scheduled to vote on the county's budget and tax rates July 11. The DeKalb school board plants to vote on its tax rate June 27. City governments are approving their budgets on various dates.

About the Author

Keep Reading

The Latest

Featured