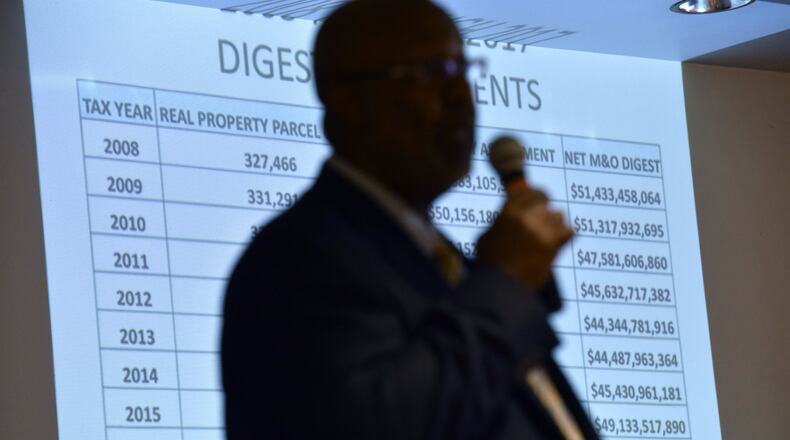

Fulton County commissioners approved the 2017 tax rate Wednesday.

The new rate, 10.38 mills, should mean a decrease in property taxes for most homeowners in the county. It is a 0.7 percent decrease over last year's tax rate for the general fund.

Sharon Whitmore, the county’s chief financial officer, said residents with a $250,000 house and a standard homestead exemption would save about $5 on their tax bill for the year.

Commissioners also approved a tax rate of .25 to cover payments of library bonds. Residents of the new city of South Fulton will pay 4.43 mills to compensate Fulton County for providing services for the four months before the city incorporated.

And property owners in the last unincorporated part of the county, the Fulton County Industrial District, will pay a tax rate of 12.16 mills for services throughout the year. They will also pay the South Fulton portion for the period before the city was formed.

For more about the tax rates, read the full story, only on myAJC.com.

About the Author

Keep Reading

The Latest

Featured