One of Atlanta’s largest law firms is relocating its headquarters after searching for a workplace that its leaders believe will outcompete employees’ home offices.

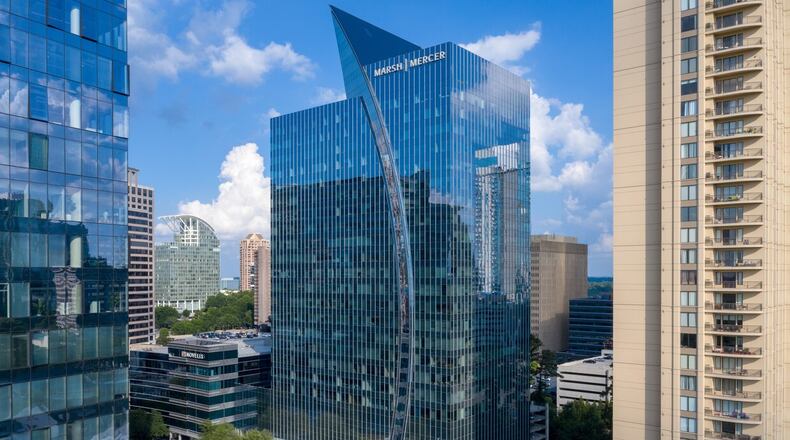

Morris, Manning & Martin LLP signed an 100,000-square-foot lease at Two Alliance Center in Buckhead, which is less than two miles from the firm’s corporate home since 1987 at Atlanta Financial Center. The law firm expects the new space within the 30-story Two Alliance Center tower to house about 280 attorneys and workers.

Simon Malko, managing partner of Morris, Manning & Martin, told The Atlanta Journal-Constitution his firm began exploring office opportunities in 2023, searching for a “commute-worthy” workplace. He said Two Alliance Center, which is located within an office park along Lenox Road with food options and amenities, has all the markings of “an office in the post-pandemic world.”

“You need to have great, appealing office space,” Malko said. “You need to have amenities, you need to have restaurants, grab-and-go (options), coffee and a place where people can go grab a drink after work if they want to.”

Metro Atlanta’s office market has struggled to recover from the rise of remote work and economic uncertainty prompted by the COVID-19 pandemic. The Atlanta are ended June with roughly a third of all office square footage empty or otherwise available for rent, according to real estate services firm CBRE.

Malko said his firm’s current lease for 130,000 square feet at Atlanta Financial Center is set to expire in 2026, but the amount of available space in the market was tempting. He said Morris, Manning & Martin looked at more than a dozen options across Buckhead and Midtown before committing to Two Alliance Center.

Lease terms were not disclosed aside from it being a long-term lease, which Malko said shows his firm’s commitment to Buckhead.

The Morris, Manning & Martin signing, which was brokered by Cushman & Wakefield, was first reported by the Atlanta Business Chronicle. The news outlet’s internal survey ranked the law firm as the sixth largest in the Atlanta market.

Credit: Bita Honarvar, bhonarvar@ajc.com

Credit: Bita Honarvar, bhonarvar@ajc.com

Highwoods Properties, based in Raleigh, North Carolina, owns the Alliance Center and Monarch Center buildings in Buckhead, which comprise a 2 million-square-foot corporate district. Heather Lamb, Highwood senior vice president and Atlanta market leader, said office landlords have to create an experience where workers “enjoy going to work every day, not just because their boss told them so.”

“Office building owners that are ahead of that trend and providing those types of environments are the ones that are luring more tenants,” Lamb said. She declined to disclose Two Alliance Center’s occupancy rate after the new tenant signing.

Leasing activity, which was dormant in the years following the COVID-19 outbreak in 2020, is starting to rebound.

Eight leases of at least 90,000 square feet were signed between April and June, according to real estate services firm JLL. About 4.7 million square feet of office leases were signed in the Atlanta area during this year’s first half, the most activity to start a year since 2020 at the start of the COVID-19 outbreak, according to CBRE.

Still, while leasing volume is up, downsizing has been common as companies rethink their footprints following the pandemic. Malko said his firm has not adopted “hoteling,” where employees use shared desks that have to be reserved, but he said they’ll have a more efficient floor plan at Two Alliance Center, allowing them to reduce their leased footprint.

Atlanta Financial Center, the firm’s prior corporate home, has made national headlines in recent months due to a financial scandal.

New York-based crowdfunding platform Nightingale tried to buy the property from Sumitomo Corp. last year for $182 million. But the deal blew up amid allegations that Nightingale CEO Elie Schwartz misappropriated investor funds, leading to a $55 million settlement that has yet to be repaid. The failed building transaction prompted federal investigations, lawsuits and investors attempting to seize Schwartz’s assets to recoup their money.