Financial law overhaul likely to be slow, despite Trump’s order

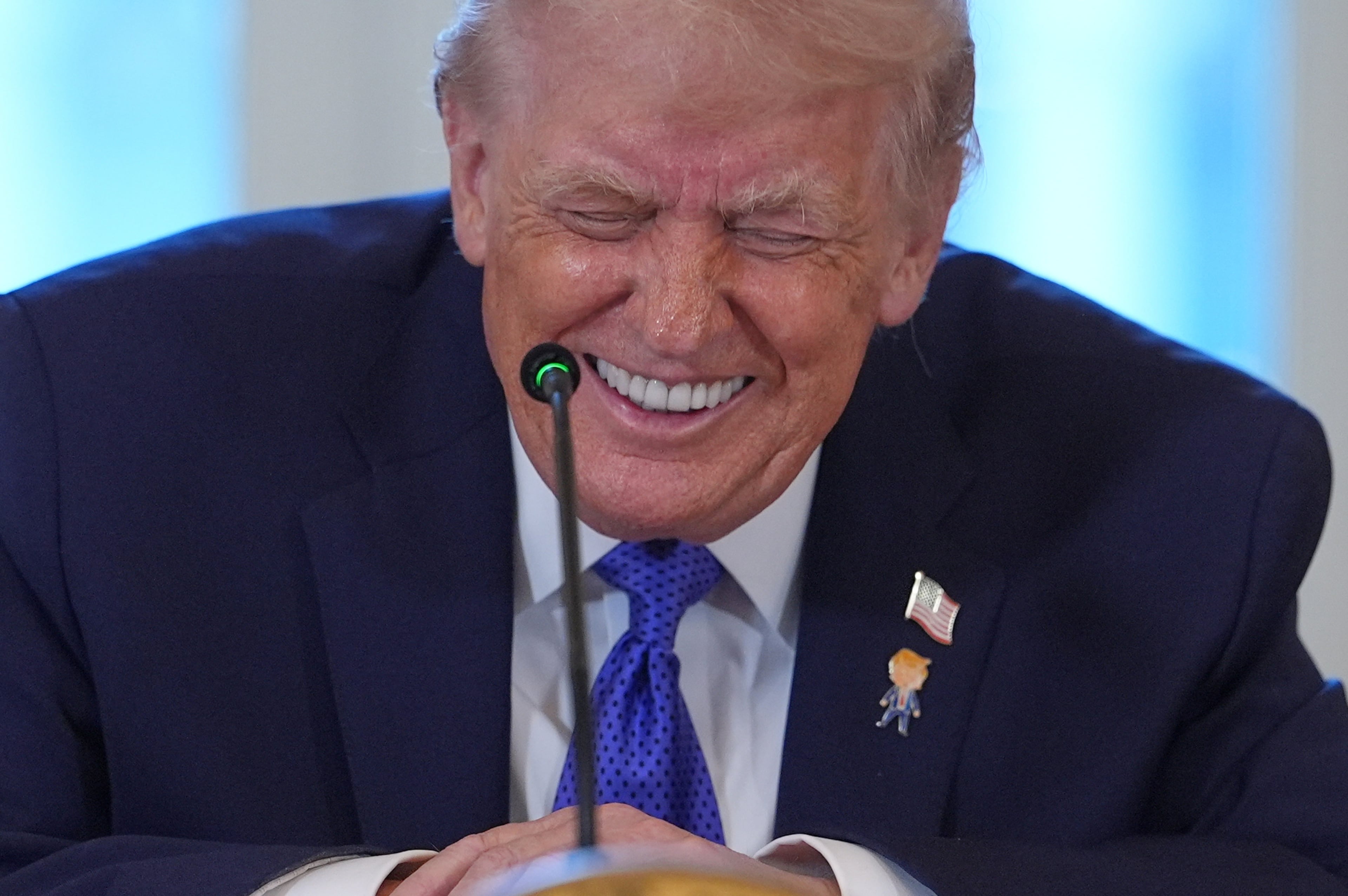

President Donald Trump signed an executive order outlining plans to scale back the sweeping Dodd-Frank financial overhaul law that lawmakers enacted after the 2008 financial crisis.

The action was paired with another order the president signed today aimed at rolling back a rule aimed at protecting retirement investors that is set to take effect in April.

But unlike one of Trump’s recent orders that had an immediate effect on travelers and immigrants, one of Friday’s actions isn’t likely to bring changes for financial institutions any time soon.

“From what we’ve heard, none of this banking regulation is (expected to change) in the first 100 days or even the first 200 days” of Trump’s administration, said Joe Brannen, president of the Georgia Bankers Association.

Meanwhile, another executive order Trump signed this week to generally freeze new rule-making by federal regulators doesn’t apply to the agencies that oversee the financial industry, said Brannen.

“Banking regulators, which are independent agencies, are exempt according to a White House spokeswoman,” the Georgia Bankers Association said Friday in a note to its members.

One of the orders Trump signed Friday establishes a framework for dismantling Dodd-Frank according to certain “core principles,” such as “empower(ing) Americans to make independent financial decisions.”

But much of Trump’s plan would likely require new legislation by lawmakers to repeal or modify the Dodd-Frank law, which limits how much risk banks can take on. The 2010 law also created a new agency, the Consumer Financial Protection Bureau, aimed at preventing consumer abuses by banks, credit card companies, payday lenders and other financial institutions.

But meanwhile, lawmakers in the Senate will be busy vetting Trump’s new cabinet members and other top managers at financial agencies for months to come, predicted Brannen.

“That’s priority,” he said. “You’ve got to get your team in place.”

Ultimately, lawmakers and Trump’s Treasury Secretary pick, Steve Mnuchin, probably won’t try to tear up Dodd-Frank, said Brannen. Banks and other financial institutions have spent years and millions of dollars changing their operations and hiring staff to meet the requirements of Dodd-Frank.

“We’ve had it now for six years,” he said. “We’ve begun to figure it out.”

Instead, he expects the Trump administration and lawmakers to concentrate on parts of the law that have brought the most objections from banks and other financial players.

Some of those areas, he said, include the so-called “Volker rule” that limits banks’ trading on Wall Street. Banks would also like to see higher asset size limits before federal rules require them to hold bigger capital reserves, or buffers against losses, he said.

Many in the financial industry, he said, also want to see a multi-person board heading the CFPB. The agency, headed by Director Richard Cordray, has aggressively gone after banks, lenders, debt collectors and credit agencies for alleged abuses, often collecting millions of dollars in civil penalties.